Since last year, many of us still remember the massive boycotts that shook some major brands in Indonesia, including UNVR and MAPI.

These boycotts were no joke—they had a huge impact on the performance of both companies.

But what’s interesting is that while both were hit hard, their recovery stories are very different.

MAPI has slowly started to bounce back, while UNVR is still grappling with multiple challenges.

Why such a difference?

Before we dive into that, let’s first take a look at Unilever’s financial performance in 3Q24.

They posted a revenue of IDR 27.4 tn, down by 10.1% yoy. Their profit took an even bigger hit, dropping to IDR 543 bn—a steep decline of 46.7% qoq and 62% yoy.

The weaker-than-expected demand is the main factor behind this, with a 16.1% drop compared to last year. And, of course, the boycott’s impact is still lingering.

During 9M24, Unilever's total profit reached IDR 3 tn. Unfortunately, this is still below our expectations, achieving only 62% of the target, and also falling short of market forecasts at 65%.

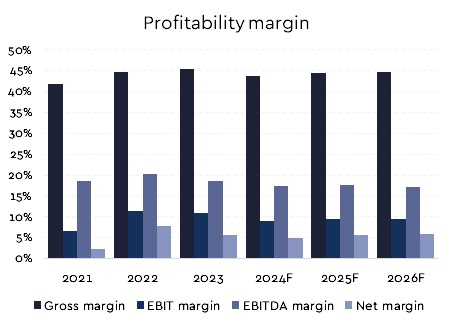

As a result, the company's margins are under increasing pressure.

Gross margin has dropped to 48.4%, and net margin has been steadily declining over the last 10 years.

This presents a significant challenge for Unilever moving forward.

Additionally, UNVR’s ROIC has been declining, which further highlights the company's diminishing efficiency in managing its capital over the years.

This indicates that Unilever is becoming less effective at leveraging its resources to generate profits.

We believe Unilever has very little chance of making a full recovery.

The reason is simple: consumers who have switched from Unilever’s products are unlikely to return.

They've found equally good alternatives, often at more affordable prices.

And there are plenty of competitors ready to take over, such as from Wings to Lion and KAO.

These brands have become go-to choices for consumers because, in addition to being cheaper, their quality matches Unilever’s.

So it’s no surprise that Unilever is struggling to compete.

Consumers are now comfortable with more affordable yet high-quality options, making it unlikely they’ll return to Unilever.

Unilever is definitely facing an uphill battle. People are downtrading—opting for cheaper alternatives—and the company is still dealing with the boycott, making it even harder to bounce back.

Unless Unilever comes up with something truly spectacular—like a game-changing product or a bold, out-of-the-box strategy—it's going to be tough for them to regain their former stronghold.

Imagine a shampoo that instantly straightens permanent curly hair in one use—now that would make waves! Hahaha

But without something like that, a comeback seems difficult.

On the other hand, MAPI, despite being hit by the boycott too, still has room for recovery, albeit slowly.

Take Zara, for example—people will eventually return because they love the quality and unique styles that are hard to replace.

Another example is Starbucks.

While there are plenty of local coffee brands that rival Starbucks in taste, Starbucks still has its distinctive flavor that’s hard for competitors to replicate.

Plus, their irresistible promos keep customers coming back.

Since MAPI's products are more in the discretionary category, once the boycott subsides, we believe they’ll recover.

And as I’ve mentioned in my previous sales notes, the new Starbucks CEO could bring fresh energy and new strategies to further fuel their recovery.