17 September 2025

Lower Interest Rates Spark a Shopping Spree

Market Commentary

0 comments

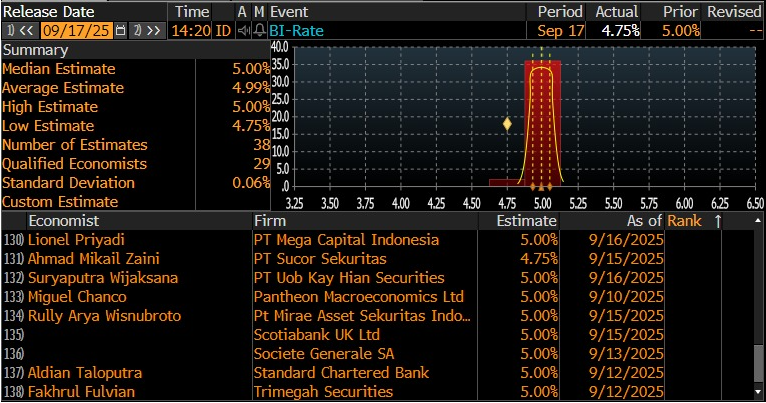

As expected by our economist, the BI RDG resulted in a 25bps cut in the BI7DRR to 4.75%. This move was largely unexpected by most investors, as the consensus had anticipated BI to hold rates steady at 5.00%, given that BI had already implemented a 25bps cut at the previous RDG, while the Federal Funds Rate remains unchanged.

The lending and deposit facility are also lowered to 5.50% and 3.75%, respectively. BI maintains its projection that loan growth will reach between 8.0 - 11.0% in 2025. In August, loan disbursements grew higher, 7.56% (YoY) (vs. 7.03% in July).

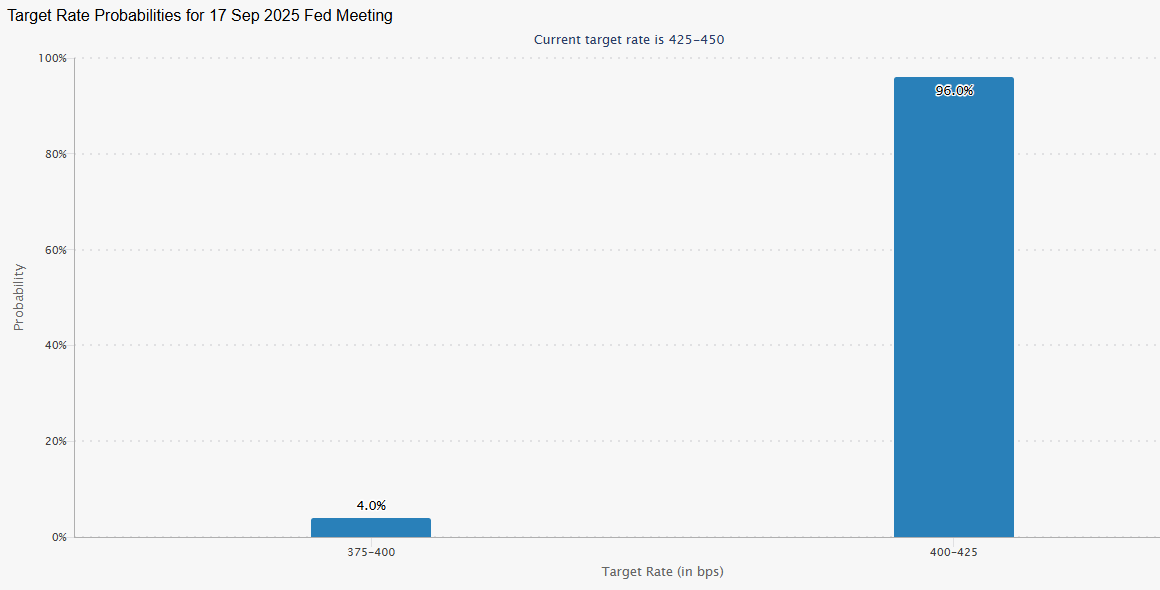

Meanwhile, the Fed is currently holding its FOMC meeting, where policymakers are weighing the next step for interest rates amid signs of moderating inflation and softer economic data. Market participants broadly expect the Fed to move toward a rate cut, as recent signals suggest more room to ease financial conditions without reigniting price pressures.

Adding to expectations, President Trump has recently urged Chair Powell and the Fed to lower rates more aggressively, framing monetary easing as necessary to sustain growth and ease borrowing costs. While the Fed maintains its independence, such political pressure, combined with improving inflation dynamics, has reinforced the likelihood that the FOMC will soon deliver its first rate cut of the current cycle.

This global monetary backdrop aligns closely with recent moves from BI. The preemptive easing reflects BI’s confidence in stable inflation and its intention to support domestic growth while keeping Indonesia’s financial markets attractive to foreign capital. Narrower policy gap between the U.S. and Indonesia is likely to reduce external pressures on the rupiah, and provide BI with greater room to maintain an accommodative stance. Together, these dynamics strengthen the case for higher liquidity and capital inflows into Indonesian markets in the near term.

Therefore, we suggest investors adopt a very aggressive stance as we welcome the pro-growth policies from both BI and the MoF. We recommend deploying current cash reserves more aggressively to a much lower level, as liquidity and capital flows are likely to rush abundantly toward Indonesia.

Written by Boris, the Broker

Comments