16 November 2025

Geopolitical Tension Vs JCI's Rally

Market Commentary

0 comments

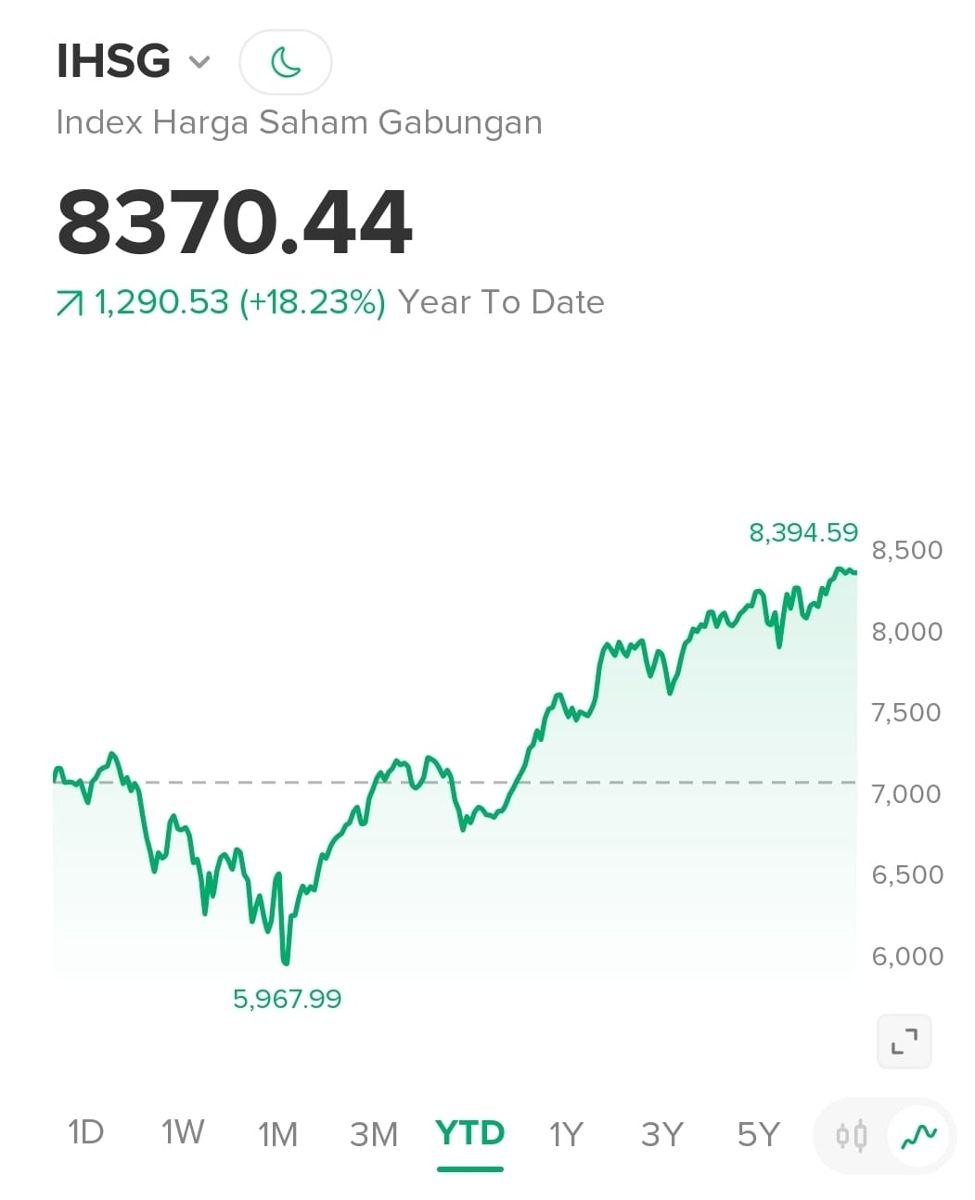

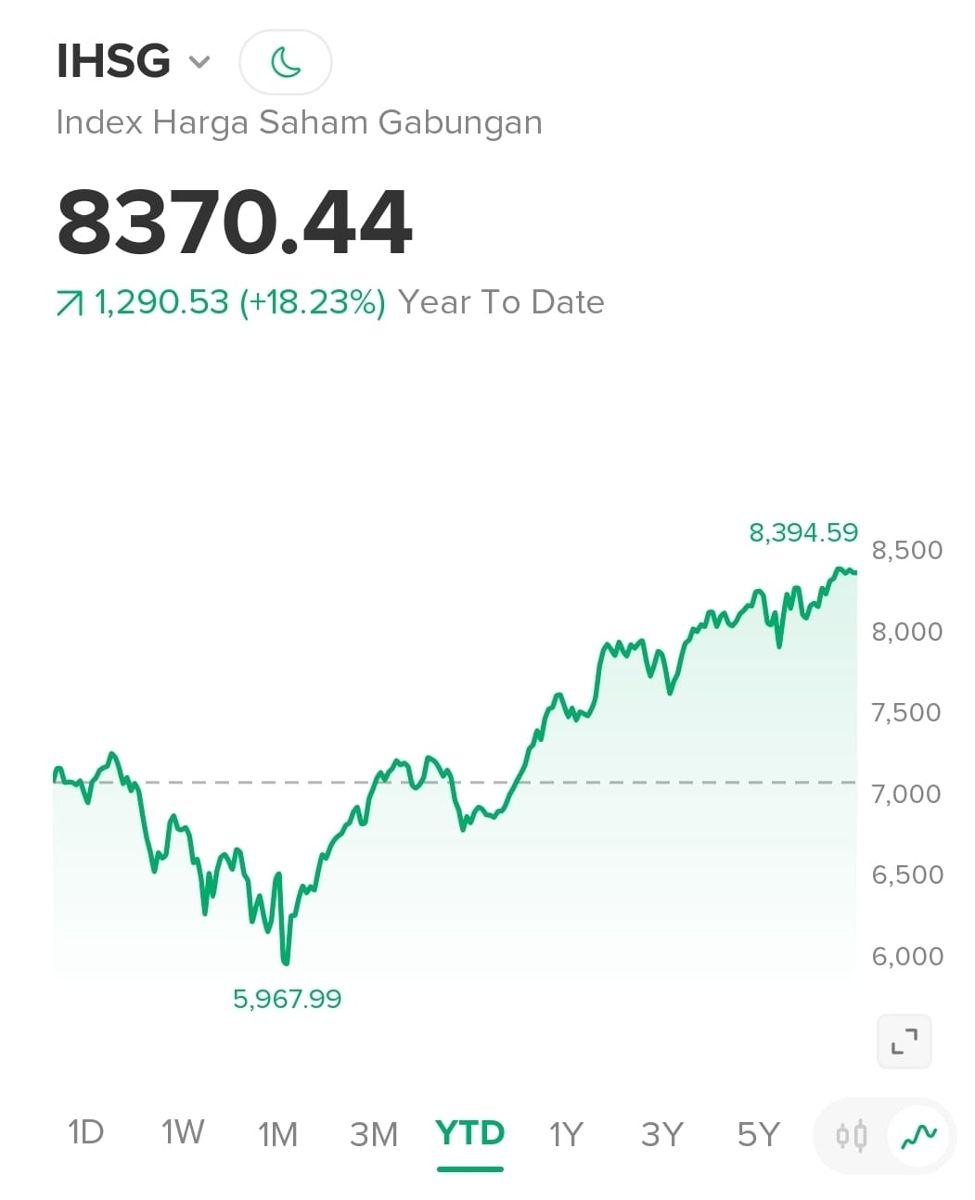

JCI has posted a very strong rebound since its April 2025 low at IDR 5,967.99, climbing to IDR 8,370 by mid-November — a clear sign of momentum and recovery. Given that large base move, its YTD performance (+18.2%) appears well supported.

On the valuation front, the market trades at a P/E of ~12.6× and a market-cap/GDP ratio in the ~61% zone, which places it in the “modestly overvalued” category under current frameworks. While the P/E isn’t egregious, the limited earnings growth implied by many studies means that much of the rally is likely sentiment and liquidity-driven.

JCI's recent rally was real and respectable, but investors should remain cautious — because unless earnings growth catches up, the market may be relying more on sentiment than fundamentals.

Japan’s protest against China’s travel advisory may appear like a small diplomatic skirmish, but it sits on top of a much deeper layer of geopolitical tension in East Asia — and it can escalate in several ways.

China’s decision to issue a travel advisory for Japan is often interpreted in the region as a political signal, not just a safety warning. When Japan formally protests, it effectively frames China’s move as “unfriendly” or “politically motivated.” This pushes both governments into a public posture of defending national pride, which tends to harden positions.

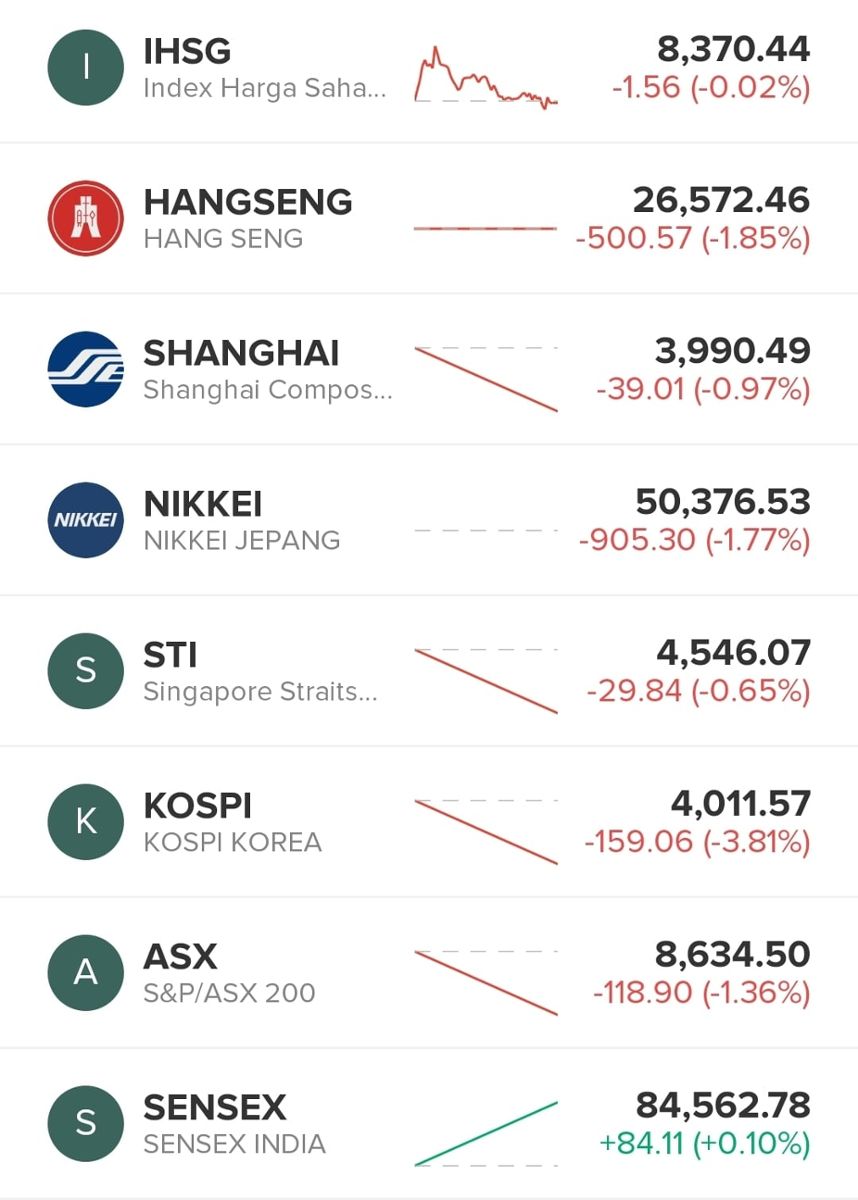

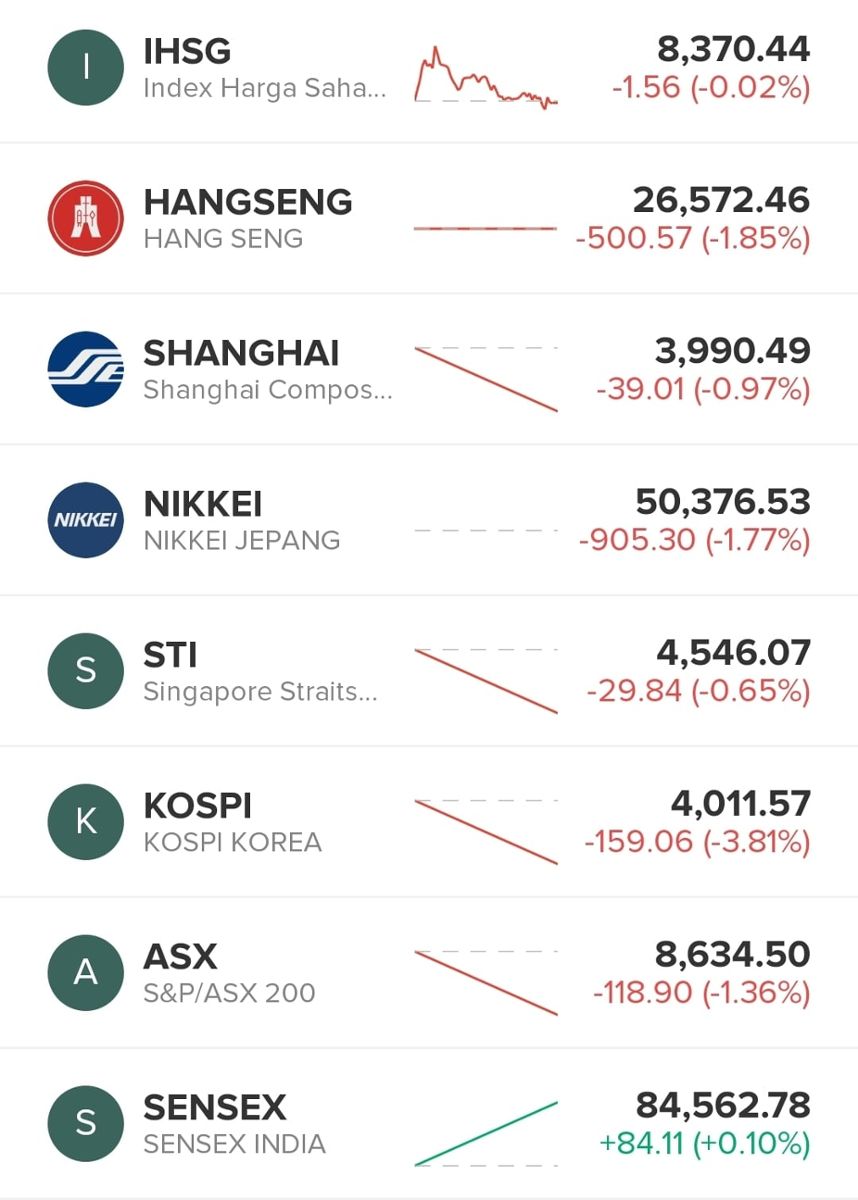

Regional Indices Performance on Friday 14th

Rising geopolitical tensions between China and Japan following Tokyo’s protests over Beijing’s travel advisory has add another layer of uncertainty to regional risk sentiment. Such developments may heighten concerns over trade disruptions, supply-chain reliability, and diplomatic instability, all of which tend to weigh on Asian equity markets.

Given this backdrop, we expect market volatility to persist in the near term. Investors should remain cautious, maintain disciplined positioning, and prioritize quality names with resilient fundamentals while monitoring further geopolitical developments closely.

On the valuation front, the market trades at a P/E of ~12.6× and a market-cap/GDP ratio in the ~61% zone, which places it in the “modestly overvalued” category under current frameworks. While the P/E isn’t egregious, the limited earnings growth implied by many studies means that much of the rally is likely sentiment and liquidity-driven.

JCI YTD Performance

JCI's recent rally was real and respectable, but investors should remain cautious — because unless earnings growth catches up, the market may be relying more on sentiment than fundamentals.

Japan’s protest against China’s travel advisory may appear like a small diplomatic skirmish, but it sits on top of a much deeper layer of geopolitical tension in East Asia — and it can escalate in several ways.

China’s decision to issue a travel advisory for Japan is often interpreted in the region as a political signal, not just a safety warning. When Japan formally protests, it effectively frames China’s move as “unfriendly” or “politically motivated.” This pushes both governments into a public posture of defending national pride, which tends to harden positions.

Regional Indices Performance on Friday 14th

Rising geopolitical tensions between China and Japan following Tokyo’s protests over Beijing’s travel advisory has add another layer of uncertainty to regional risk sentiment. Such developments may heighten concerns over trade disruptions, supply-chain reliability, and diplomatic instability, all of which tend to weigh on Asian equity markets.

Given this backdrop, we expect market volatility to persist in the near term. Investors should remain cautious, maintain disciplined positioning, and prioritize quality names with resilient fundamentals while monitoring further geopolitical developments closely.

Written by Boris, the Broker

Comments