06 October 2025

Renewed Stronger

Market Commentary

0 comments

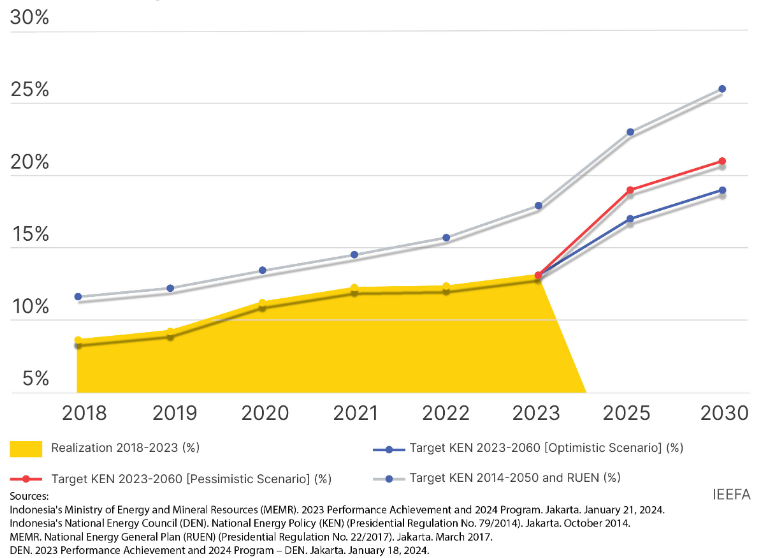

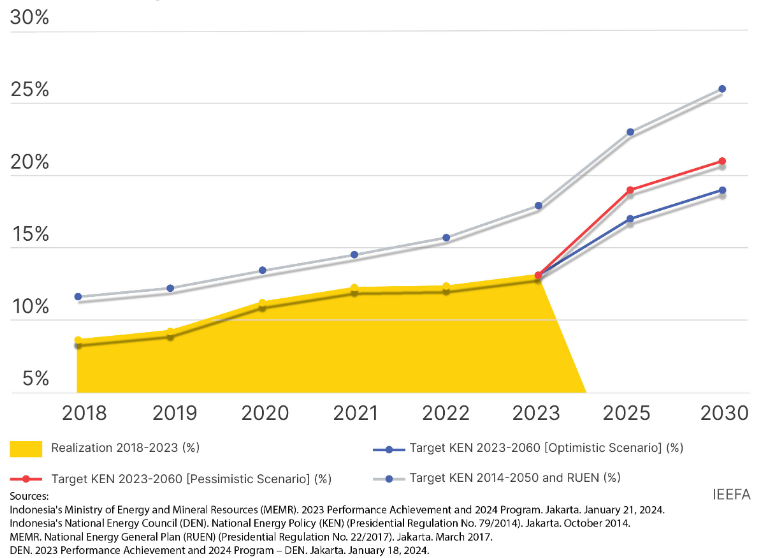

Over the past several years, the performance of renewable energy companies has shown a mixed but generally upward long-term trend. Early in the decade, optimism around clean energy policies and global decarbonization targets drove strong rallies in renewable stocks such as NextEra Energy (U.S.) and Ørsted (Denmark). However, from 2022 to 2023, rising interest rates and higher project costs pressured valuations, leading to a correction across the sector.

Recently, sentiment has begun to recover as inflation eases and governments reaffirm green energy commitments. For instance, NextEra Energy’s share price has rebounded steadily in 2025, supported by stable earnings and renewed investment in solar and wind capacity. Overall, while renewable energy stocks have faced short-term volatility, the sector continues to attract strong structural demand as the global energy transition accelerates.

.png)

Danantara recently signed a USD 10 billion partnership with ACWA Power to develop projects in green hydrogen, solar, and water desalination, while also preparing to roll out eight waste-to-energy plants across major cities, including Jakarta, by late 2025.

In parallel, Danantara is facilitating geothermal collaborations between Pertamina and PLN to expand clean power capacity. Overall, the fund sees up to USD 200 billion in renewable investment potential—spanning solar, hydro, biomass, and storage systems—aligning with Indonesia’s target of 42.6 GW of renewable capacity by 2034.

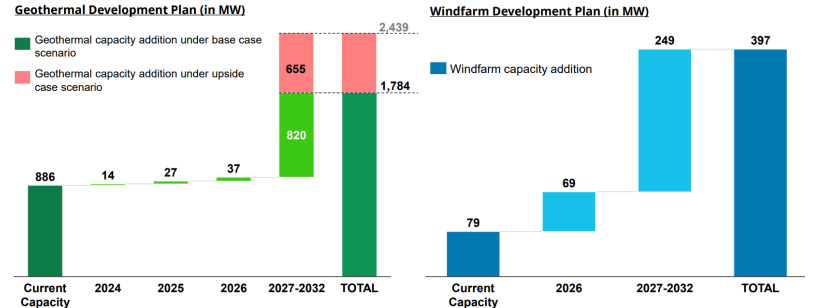

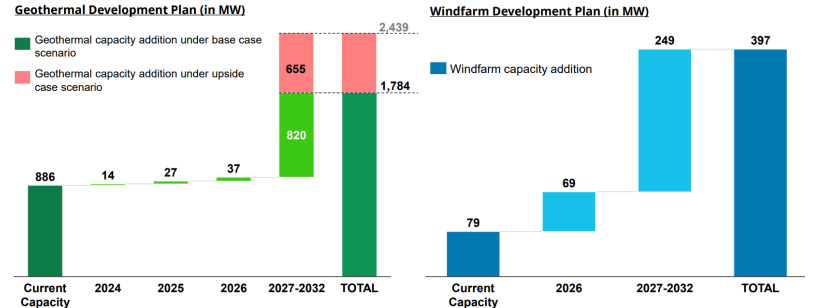

BREN is contributing towards Danantara's renewable energy plan as BREN’s installed capacity is projected to increase from 961 MW in 2024 to 2.8 GW by 2032, positioning the company as a leading regional hub for renewable energy. This growth will be driven primarily by the Suoh Sekincau and Hamiding geothermal projects, complemented by steady expansion in wind power generation. Accordingly, we expect BREN to achieve an earnings CAGR of 28% over the next eight years.

Recently, sentiment has begun to recover as inflation eases and governments reaffirm green energy commitments. For instance, NextEra Energy’s share price has rebounded steadily in 2025, supported by stable earnings and renewed investment in solar and wind capacity. Overall, while renewable energy stocks have faced short-term volatility, the sector continues to attract strong structural demand as the global energy transition accelerates.

NextEra Energy and Ørsted Share Price Performance

.png)

Danantara recently signed a USD 10 billion partnership with ACWA Power to develop projects in green hydrogen, solar, and water desalination, while also preparing to roll out eight waste-to-energy plants across major cities, including Jakarta, by late 2025.

In parallel, Danantara is facilitating geothermal collaborations between Pertamina and PLN to expand clean power capacity. Overall, the fund sees up to USD 200 billion in renewable investment potential—spanning solar, hydro, biomass, and storage systems—aligning with Indonesia’s target of 42.6 GW of renewable capacity by 2034.

Indonesia’s Renewable Energy Mix: Targets and Realization

BREN is contributing towards Danantara's renewable energy plan as BREN’s installed capacity is projected to increase from 961 MW in 2024 to 2.8 GW by 2032, positioning the company as a leading regional hub for renewable energy. This growth will be driven primarily by the Suoh Sekincau and Hamiding geothermal projects, complemented by steady expansion in wind power generation. Accordingly, we expect BREN to achieve an earnings CAGR of 28% over the next eight years.

Future Development Plans

We project BREN to achieve an earnings CAGR of 28% over the next eight years, reaching USD 810mn by 2033. This growth will be primarily supported by a 17% CAGR in capacity expansion, along with higher tariff assumptions from potential export opportunities (averaging USD 0.13/kWh in our base case). These drivers provide strong cash flow visibility and earnings resilience, further reinforced by Indonesia’s accelerating renewable energy transition.

We assume coverage on BREN with a BUY rating and a DCF-based TP of Rp19,800/sh.

Written by Boris, the Broker

Comments