09 November 2025

Slow Dancing in a Burning Room

Market Commentary

0 comments

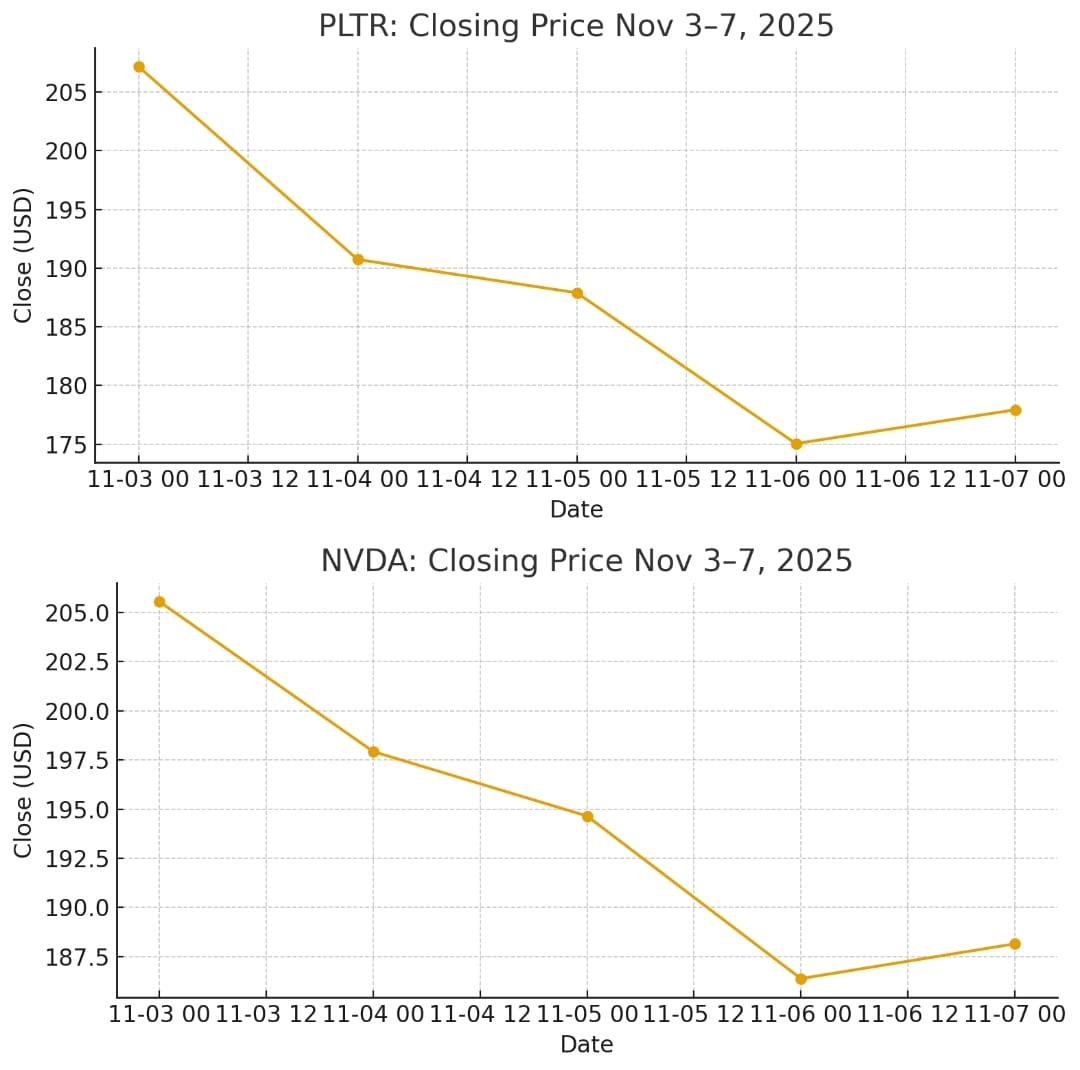

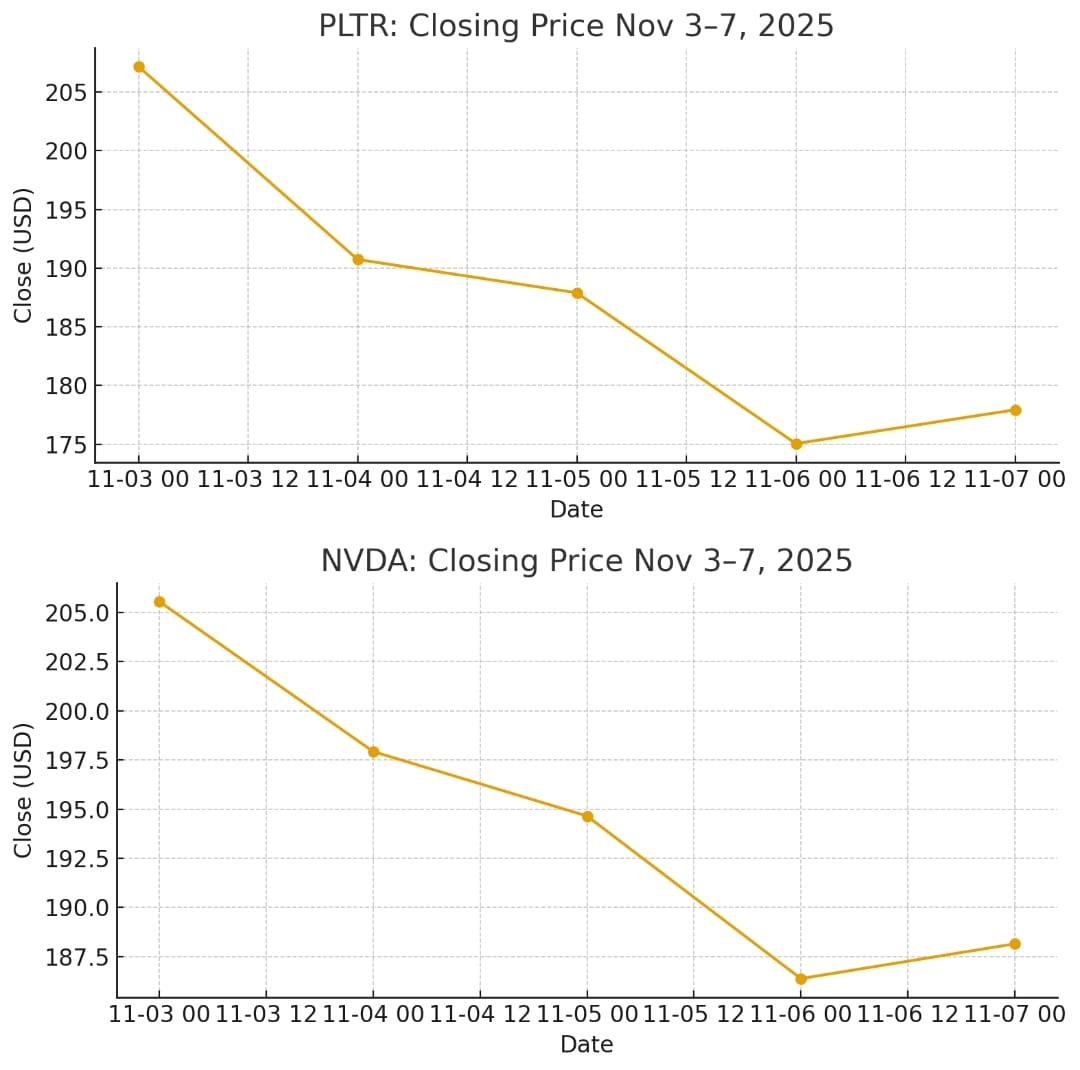

Michael Burry’s Scion Asset Management disclosed large bearish option positions (puts) against Palantir (PLTR) and NVIDIA (NVDA) in filings and press reports. The reporting indicates Scion held put options with a notional size roughly USD 912mn on Palantir (about 5 million shares worth of puts) and USD 187mn on NVIDIA (about 1 million shares worth of puts) as of the end of Q3 (filings surfaced publicly early November). The move was described in multiple press reports as Scion “betting against” those AI darlings by buying puts rather than selling stock short outright.

the positions were reported from quarter-end/SEC filings; media coverage broke Nov 3–4 which is when market participants reacted. Palantir reported strong Q3 results and raised guidance, yet the stock still pulled back — partly because of valuation concerns and the public visibility of a big short.

Berkshire Hathaway’s cash reserves have climbed to an all-time high of USD 381.7bn as of September 2025, reflecting Warren Buffett’s cautious stance amid uncertain market conditions. The company has been a net seller of equities this year and has slowed share buybacks, opting to retain more liquidity while valuations remain elevated.

This record cash pile highlights Berkshire’s defensive positioning — preserving “dry powder” to seize opportunities when markets correct or to shield capital during volatility. Strong operating earnings, combined with disciplined capital deployment, have positioned the firm with unmatched flexibility heading into 2026.

.jpeg)

However, as mentioned in our strategy report, the bubble could burst next month, within the next three years, or perhaps never at all. However, observing how seasoned investors are positioning themselves, we recommend staying invested in selected stocks while keeping a sizeable cash reserve to prepare for potential downside risks.

The combination of easing inflation, a lower interest rate outlook from Bank Indonesia, and ample system liquidity could spur stronger credit growth and corporate earnings recovery. Together, these factors create an environment conducive for risk-on sentiment and renewed upside momentum in equities.

After all, why stop dancing when the music is still playing?

the positions were reported from quarter-end/SEC filings; media coverage broke Nov 3–4 which is when market participants reacted. Palantir reported strong Q3 results and raised guidance, yet the stock still pulled back — partly because of valuation concerns and the public visibility of a big short.

Berkshire Hathaway’s cash reserves have climbed to an all-time high of USD 381.7bn as of September 2025, reflecting Warren Buffett’s cautious stance amid uncertain market conditions. The company has been a net seller of equities this year and has slowed share buybacks, opting to retain more liquidity while valuations remain elevated.

This record cash pile highlights Berkshire’s defensive positioning — preserving “dry powder” to seize opportunities when markets correct or to shield capital during volatility. Strong operating earnings, combined with disciplined capital deployment, have positioned the firm with unmatched flexibility heading into 2026.

.jpeg)

However, as mentioned in our strategy report, the bubble could burst next month, within the next three years, or perhaps never at all. However, observing how seasoned investors are positioning themselves, we recommend staying invested in selected stocks while keeping a sizeable cash reserve to prepare for potential downside risks.

The combination of easing inflation, a lower interest rate outlook from Bank Indonesia, and ample system liquidity could spur stronger credit growth and corporate earnings recovery. Together, these factors create an environment conducive for risk-on sentiment and renewed upside momentum in equities.

After all, why stop dancing when the music is still playing?

Written by Boris, the Broker

Comments