21 January 2025

2024's Balance

Market Commentary

0 comments

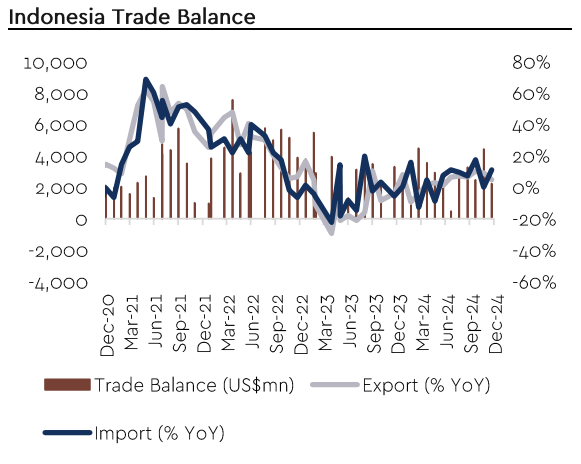

Indonesia has maintained a trade surplus through the end of 2024, although the figure has slightly declined. In December 2024, the trade surplus stood at USD 2.24 bn, lower than November’s USD 4.42 bn.

In 2024, Indonesia’s total trade surplus reached USD 31 bn, which is smaller compared to USD 36 bn in 2023.

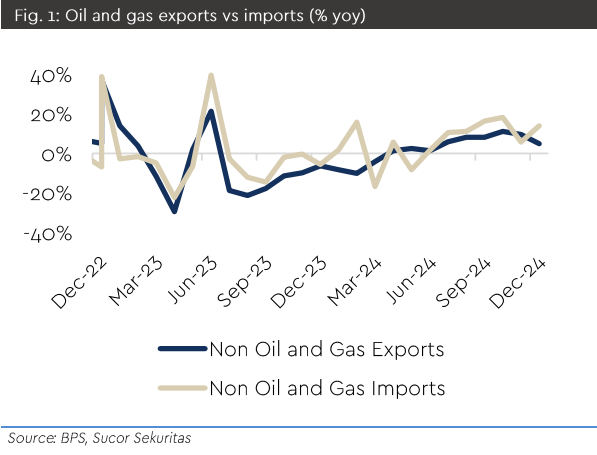

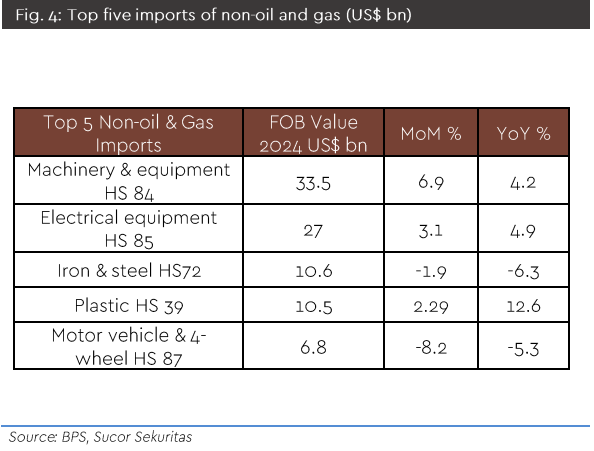

The main reason for this decline is the increase in non-oil and gas imports, which grew by 6.4% yoy, while non-oil and gas exports only grew by 2.4%.

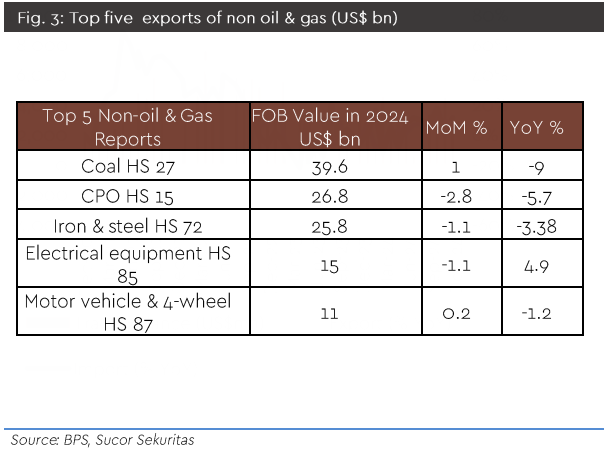

Indonesia’s export growth in 2024 was under pressure, shrinking by 2.2% yoy. However, there’s good news: non-oil and gas exports increased by 2.4%, driven by higher exports of nickel products and gold.

Unfortunately, exports of key commodities like CPO, coal, and steel experienced significant declines.

Oil and gas exports also dipped slightly by 0.28%, largely due to stable energy prices throughout the year.

Looking ahead, Indonesia’s exports in 2025 are expected to decline moderately, affected by China’s slowing economy and lower commodity prices. In 2024, exports to China dropped by 3.3%.

Additionally, there’s a risk of the U.S. reinstating tariffs on machinery, electronic equipment, and vehicle components.

On a brighter note, exports to the U.S. grew by 13% yoy in 2024, although we are projected to weaken in 2025.

Growth in exports to India, now Indonesia’s third-largest trading partner, is expected to help offset some of the losses from other markets.

On the import side, Indonesia’s demand continues to rise, with imports increasing by 5.3% in 2024. This includes a 6.0% rise in non-oil and gas imports and a slight 1.2% increase in oil and gas imports.

The relatively stable Brent oil price, averaging USD 80/barrel in 2024, helped limit the rise in oil imports.

In 2025, Indonesia’s economy is expected to benefit from a projected drop in oil prices to USD 60/barrel.

This decrease could happen if Trump’s policies succeed in boosting oil production and easing the conflict in Ukraine.

Lower oil prices are expected to reduce import costs and support Indonesia’s trade surplus, even though non-oil and gas and oil imports are likely to keep growing.

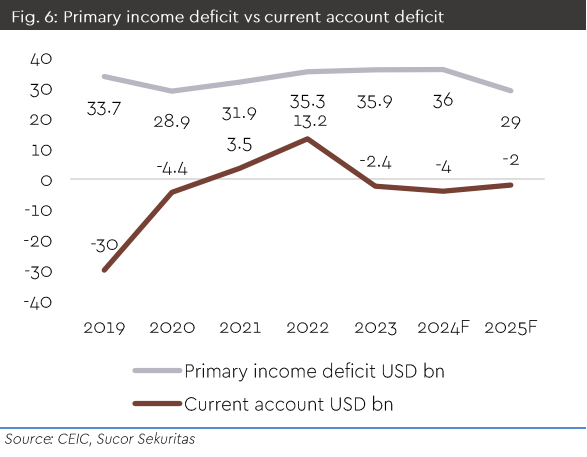

However, challenges remain. The narrowing trade surplus in 2024 has slightly widened Indonesia’s current account deficit, from -0.1% of GDP in 2023 to -0.44% in 2024.

In 2025, the government is focusing on reducing this deficit and strengthening the rupiah.

To address this, the government is focusing on strategies such as attracting more investments, reducing capital outflows, and encouraging exporters to keep their earnings within the country through a tax amnesty program.

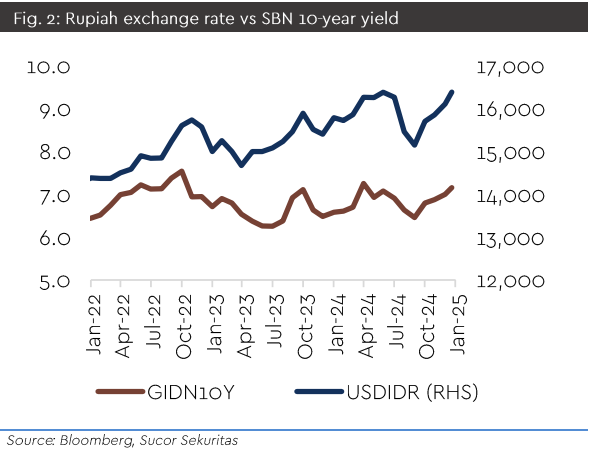

If these efforts are successful, the current account deficit is expected to shrink back to -0.1% of GDP in 2025, and the rupiah could strengthen to IDR 15,100/USD.

In addition, the yield on 10-year government bonds is projected to drop to 5.5% by the end of 2025. All of these factors create optimism that Indonesia’s economy will remain stable and strong despite global challenges.

In 2024, Indonesia’s total trade surplus reached USD 31 bn, which is smaller compared to USD 36 bn in 2023.

The main reason for this decline is the increase in non-oil and gas imports, which grew by 6.4% yoy, while non-oil and gas exports only grew by 2.4%.

Indonesia’s export growth in 2024 was under pressure, shrinking by 2.2% yoy. However, there’s good news: non-oil and gas exports increased by 2.4%, driven by higher exports of nickel products and gold.

Unfortunately, exports of key commodities like CPO, coal, and steel experienced significant declines.

Oil and gas exports also dipped slightly by 0.28%, largely due to stable energy prices throughout the year.

Looking ahead, Indonesia’s exports in 2025 are expected to decline moderately, affected by China’s slowing economy and lower commodity prices. In 2024, exports to China dropped by 3.3%.

Additionally, there’s a risk of the U.S. reinstating tariffs on machinery, electronic equipment, and vehicle components.

On a brighter note, exports to the U.S. grew by 13% yoy in 2024, although we are projected to weaken in 2025.

Growth in exports to India, now Indonesia’s third-largest trading partner, is expected to help offset some of the losses from other markets.

On the import side, Indonesia’s demand continues to rise, with imports increasing by 5.3% in 2024. This includes a 6.0% rise in non-oil and gas imports and a slight 1.2% increase in oil and gas imports.

The relatively stable Brent oil price, averaging USD 80/barrel in 2024, helped limit the rise in oil imports.

In 2025, Indonesia’s economy is expected to benefit from a projected drop in oil prices to USD 60/barrel.

This decrease could happen if Trump’s policies succeed in boosting oil production and easing the conflict in Ukraine.

Lower oil prices are expected to reduce import costs and support Indonesia’s trade surplus, even though non-oil and gas and oil imports are likely to keep growing.

However, challenges remain. The narrowing trade surplus in 2024 has slightly widened Indonesia’s current account deficit, from -0.1% of GDP in 2023 to -0.44% in 2024.

In 2025, the government is focusing on reducing this deficit and strengthening the rupiah.

To address this, the government is focusing on strategies such as attracting more investments, reducing capital outflows, and encouraging exporters to keep their earnings within the country through a tax amnesty program.

If these efforts are successful, the current account deficit is expected to shrink back to -0.1% of GDP in 2025, and the rupiah could strengthen to IDR 15,100/USD.

In addition, the yield on 10-year government bonds is projected to drop to 5.5% by the end of 2025. All of these factors create optimism that Indonesia’s economy will remain stable and strong despite global challenges.

Written by Boris, the Broker

Comments