19 November 2024

Finding Opportunity Amid Chaos

Market Commentary

0 comments

Have you ever read the news and thought, "Wow, the world just keeps getting messier"?

Well, here’s the latest shocker: U.S has just stirred the pot on the international stage. President Joe Biden has made a bold, unexpected move, officially giving Ukraine the green light to strike Russian territory using long-range American missiles, including the powerful ATACMS.

Until now, U.S. policy was clear, Ukraine could only use American-supplied weapons within its own borders.

So even with advanced weapons, Ukraine’s hands were somewhat tied.

But now? It’s like Biden just said, “Go for it, full send!” And this is no small deal, missiles like ATACMS can hit faraway targets with pinpoint accuracy.

The reasoning behind all this? It’s pretty clear. Russia recently deployed nearly 50,000 troops to Kursk, a southern region that’s been a hot battleground since last summer.

Kursk became a flashpoint after Ukraine launched a massive offensive there, and now Russia seems determined to strike back, not just to regain control but to send a message: “Look, we’re still strong!”

To make things even more intense, reports suggest thousands of North Korean soldiers are now joining Russia’s ranks in Kursk.

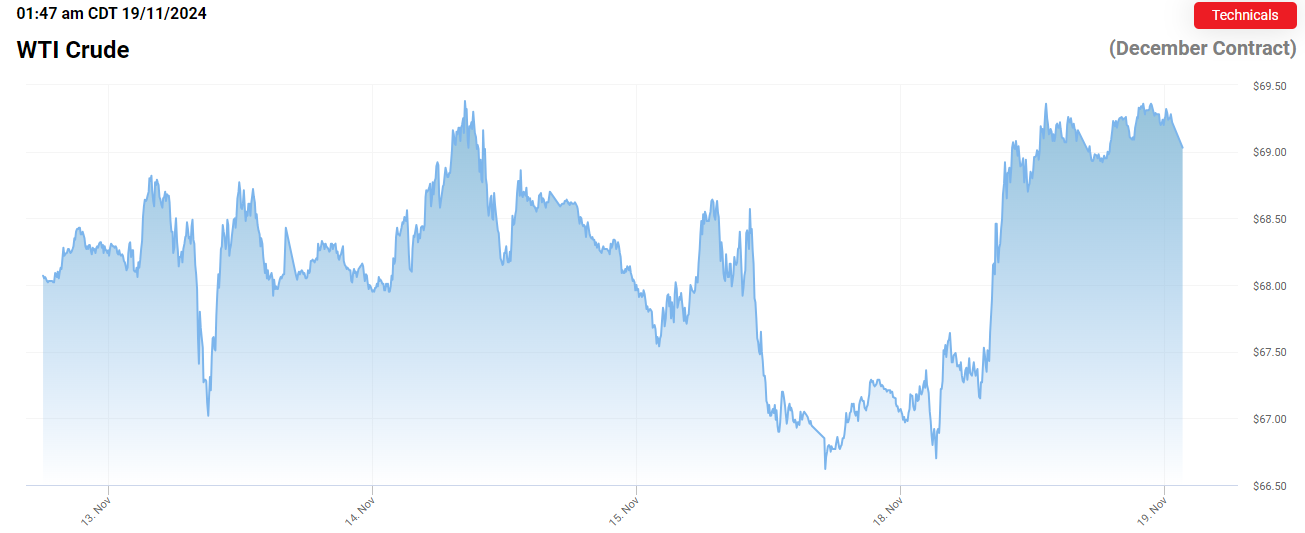

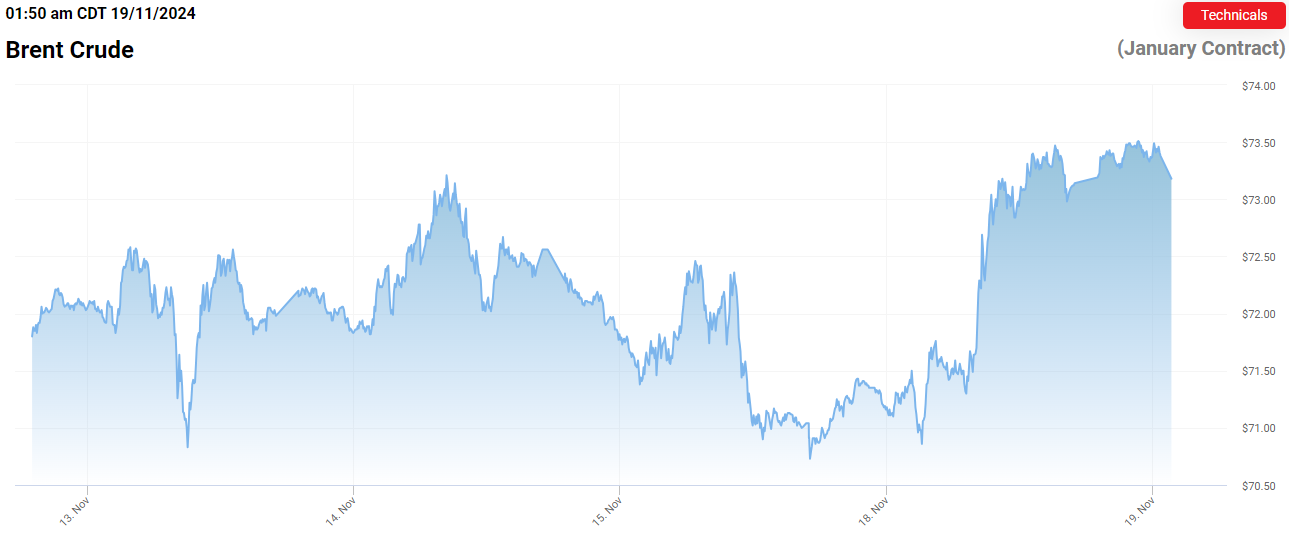

The ripple effects are already visible on global markets. Geopolitical tensions have driven oil prices higher. Crude oil recently hit USD 69.37, while Brent oil climbed to USD 73.50.

If the conflict keeps escalating, we could see even more dramatic price hikes. As I’ve highlighted in previous sales notes, this situation presents a big opportunity for ENRG.

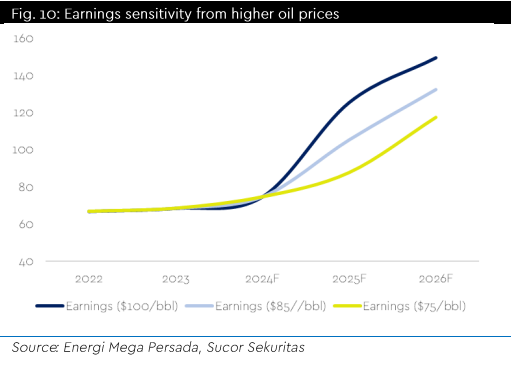

ENRG is strategically positioned to benefit from rising oil prices. Even if they play it conservatively and base their financial planning on an average oil price of USD 70-USD 78/barrel, any sustained increase in prices could significantly boost their revenue.

For instance, in a moderate scenario with oil at USD 85/barrel, ENRG’s net profit could jump to USD 105 mn by 2025, compared to the base case projection of USD 88 mn. That’s solid growth.

But it gets even better. With ENRG’s dominant oil production portfolio and efficient operations that keep production costs low, they’re primed to capitalize on higher oil prices, widening their profit margins.

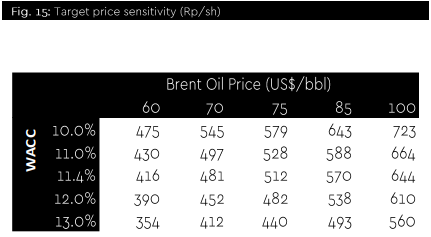

If geopolitical tensions continue, whether from the Ukraine-Russia conflict or potential escalation in the Middle East, we could see oil prices soar to USD 100/barrel. In that scenario, we project ENRG’s fair value could reach IDR 723/share.

Even in a more conservative case, with oil at just USD 60/barrel, sensitivity analysis shows a fair value of IDR 354/share, proving ENRG’s strong fundamentals and making it an attractive energy sector investment.

This combination of resilience and upside potential positions ENRG as a standout player, especially with global oil trends pointing upward amidst escalating geopolitical tensions.

Well, here’s the latest shocker: U.S has just stirred the pot on the international stage. President Joe Biden has made a bold, unexpected move, officially giving Ukraine the green light to strike Russian territory using long-range American missiles, including the powerful ATACMS.

Until now, U.S. policy was clear, Ukraine could only use American-supplied weapons within its own borders.

So even with advanced weapons, Ukraine’s hands were somewhat tied.

But now? It’s like Biden just said, “Go for it, full send!” And this is no small deal, missiles like ATACMS can hit faraway targets with pinpoint accuracy.

The reasoning behind all this? It’s pretty clear. Russia recently deployed nearly 50,000 troops to Kursk, a southern region that’s been a hot battleground since last summer.

Kursk became a flashpoint after Ukraine launched a massive offensive there, and now Russia seems determined to strike back, not just to regain control but to send a message: “Look, we’re still strong!”

To make things even more intense, reports suggest thousands of North Korean soldiers are now joining Russia’s ranks in Kursk.

The ripple effects are already visible on global markets. Geopolitical tensions have driven oil prices higher. Crude oil recently hit USD 69.37, while Brent oil climbed to USD 73.50.

If the conflict keeps escalating, we could see even more dramatic price hikes. As I’ve highlighted in previous sales notes, this situation presents a big opportunity for ENRG.

ENRG is strategically positioned to benefit from rising oil prices. Even if they play it conservatively and base their financial planning on an average oil price of USD 70-USD 78/barrel, any sustained increase in prices could significantly boost their revenue.

For instance, in a moderate scenario with oil at USD 85/barrel, ENRG’s net profit could jump to USD 105 mn by 2025, compared to the base case projection of USD 88 mn. That’s solid growth.

But it gets even better. With ENRG’s dominant oil production portfolio and efficient operations that keep production costs low, they’re primed to capitalize on higher oil prices, widening their profit margins.

If geopolitical tensions continue, whether from the Ukraine-Russia conflict or potential escalation in the Middle East, we could see oil prices soar to USD 100/barrel. In that scenario, we project ENRG’s fair value could reach IDR 723/share.

Even in a more conservative case, with oil at just USD 60/barrel, sensitivity analysis shows a fair value of IDR 354/share, proving ENRG’s strong fundamentals and making it an attractive energy sector investment.

This combination of resilience and upside potential positions ENRG as a standout player, especially with global oil trends pointing upward amidst escalating geopolitical tensions.

Written by Boris, the Broker

Comments