08 May 2025

Mining Beyond Coal

Market Commentary

0 comments

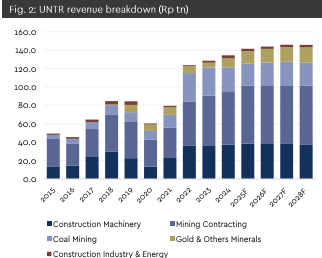

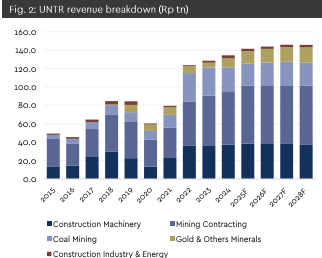

UNTR is increasingly shining as more than just a coal player — its gold segment is emerging as a true standout. Gold now contributes 9% of revenue (up from 6% last quarter) and 13% of profit (vs. 8%), fueled by an impressive 18% jump in sales volume and a 37% surge in selling price. Backed by robust production at Sumbawa Jutaraya and Martabe, gold is playing a key role in cushioning the company from coal market pressures — and management expects this momentum to continue.

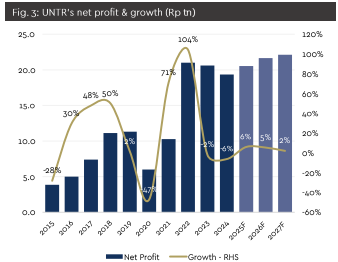

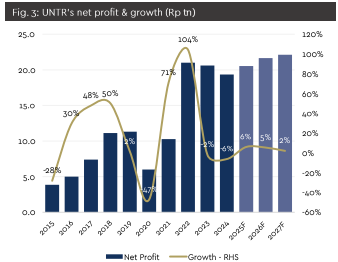

Beyond gold, Komatsu equipment sales remain resilient (+23% YoY), and coking coal volumes surged 44%, showing that the company’s diversification is paying off. Looking into 2025, UNTR targets net profit of ~Rp20.5tn, supported by Rp14–16tn in free cash flow in 2025-26F — creating room for attractive shareholder returns, including an ~9% dividend yield.

While 1Q25 earnings were softer due to lower coal prices and heavy rains, the underlying story remains compelling. At just 4.1x 2025F P/E, UNTR offers a rare combination: exposure to gold’s upside, stable cash flows, and deep value.

Although coal market pressures and weather disruptions could still weigh on near-term performance, UNTR’s growing gold business, solid operations, and cheap valuation make it one of the most interesting energy and gold plays out there. We reiterate our BUY call with a target price of Rp39,500 — a compelling value play with gold-led resilience.

Beyond gold, Komatsu equipment sales remain resilient (+23% YoY), and coking coal volumes surged 44%, showing that the company’s diversification is paying off. Looking into 2025, UNTR targets net profit of ~Rp20.5tn, supported by Rp14–16tn in free cash flow in 2025-26F — creating room for attractive shareholder returns, including an ~9% dividend yield.

While 1Q25 earnings were softer due to lower coal prices and heavy rains, the underlying story remains compelling. At just 4.1x 2025F P/E, UNTR offers a rare combination: exposure to gold’s upside, stable cash flows, and deep value.

Although coal market pressures and weather disruptions could still weigh on near-term performance, UNTR’s growing gold business, solid operations, and cheap valuation make it one of the most interesting energy and gold plays out there. We reiterate our BUY call with a target price of Rp39,500 — a compelling value play with gold-led resilience.

Written by Boris, the Broker

Comments