Amidst the global wave of factory relocations from China and East Asia, PT Kawasan Industri Jababeka Tbk (KIJA) stands as a primary beneficiary ready to accelerate. Management has explicitly projected 2026 to be a period of massive expansion, fueled by high-growth sectors such as data centers, automotive components, and metal downstreaming. With integrated logistics infrastructure and solid national economic stability, KIJA is no longer just a land provider, it has become the new center of gravity for manufacturing investment in Southeast Asia.

.png)

The company's appeal is further strengthened by its agility in capturing modern business trends. The recent launch of Jababeka Bizpark, a multipurpose commercial building in Cikarang, directly addresses the skyrocketing demand for efficient business ecosystems. By integrating sales, operations, and storage into a single strategic location, KIJA is tapping into the booming e-commerce and logistics sector. This product diversification not only optimizes land utility but also creates a more resilient and diversified revenue stream.

The company's appeal is further strengthened by the long-awaited completion of critical infrastructure. The Serang-Panimbang toll road has now reached 90% progress, meaning the 1,000-hectare "hidden gem" in Tanjung Lesung is set for immediate value unlocking as accessibility opens up. Furthermore, the company’s strategy to collaborate with global strategic partners will inject world-class efficiency and capabilities. This is the phase where KIJA’s dormant assets begin their transformation into tangible profit engines.

.png)

The most crucial point for investors is the valuation momentum. While KIJA’s P/B ratio has climbed to 1.21x following its recent price action, this shift actually signals a positive market re-rating. Investors are finally moving away from valuing KIJA at a distressed discount and are now pricing in its future growth. With a target price of Rp550, there is still significant upside remaining. Our Analysts emphasize that this target remains conservative, as it does not yet factor in the full potential of the Morotai and Tanjung Lesung projects. In short, you are capturing an expanding business as it breaks out toward its true intrinsic value.

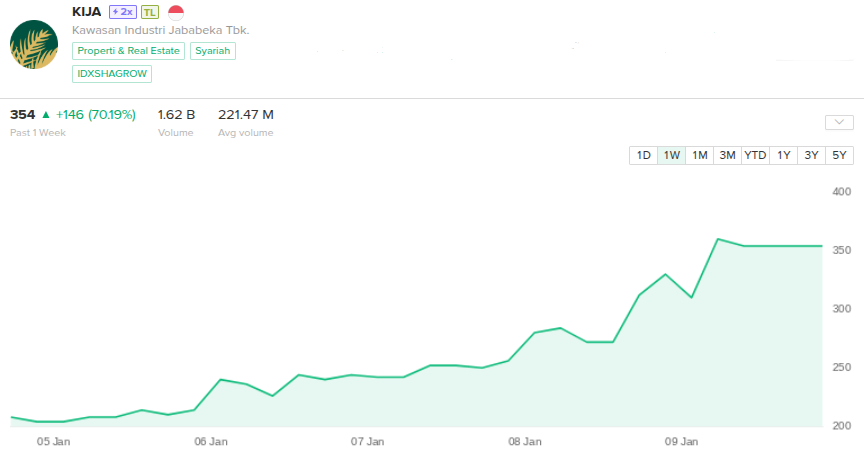

The price has already begun to rally, moving from the Rp200 level to the Rp350 range in a short period. This confirms that the market is waking up to KIJA's true potential. Despite the recent run-up, the gap toward the Rp550 target remains wide, making this the strategic moment to enter before the next leg up as the company’s 2026 expansion plans fully materialize.