15 October 2025

The Lagging Gold Investment

Market Commentary

0 comments

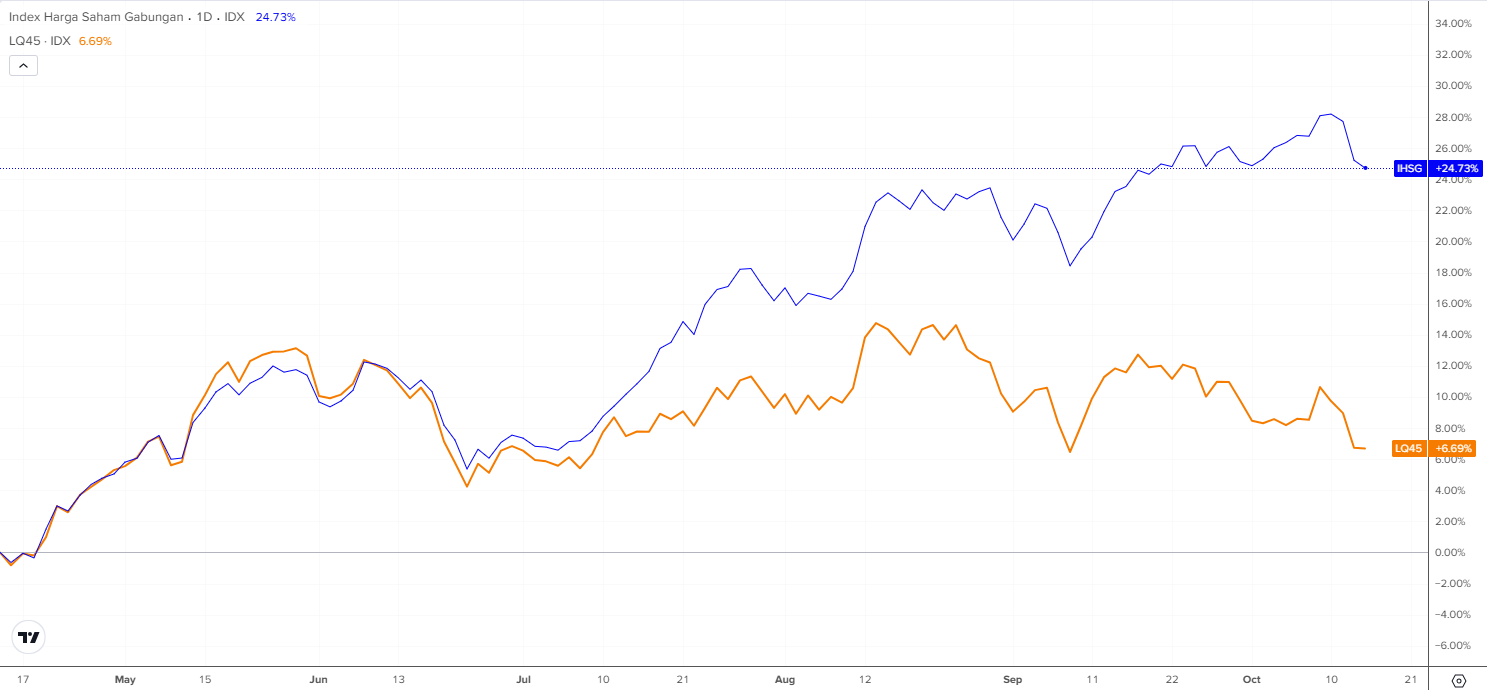

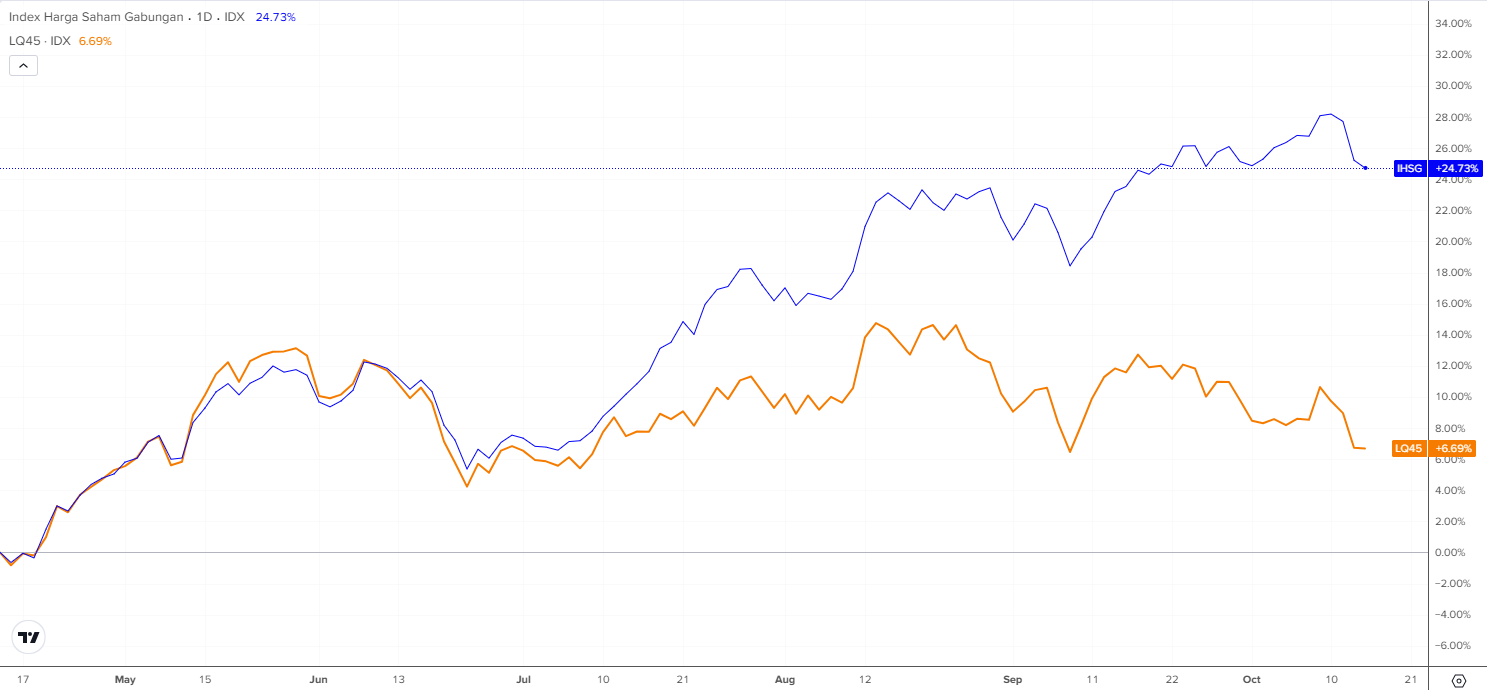

Over the past several months, the Jakarta Composite Index (JCI) has shown a strong upward momentum, significantly outperforming its blue-chip counterpart, LQ45. JCI surged by around +24.7%, while LQ45 only gained about +6.7% in the same period. This divergence highlights how the recent rally has been broad-based, driven not only by large-cap names but also by mid-cap and thematic stocks that benefited from improving domestic liquidity and investor rotation.

In contrast, the LQ45 index — dominated by established blue chips — lagged behind, suggesting that investors have been increasingly shifting toward diversified growth stories beyond traditional market leaders. Overall, the data underline JCI’s strong resilience and broad-based participation in the current market rally.

JCI and LQ45 Performance

Gold price has been soaring to record highs, reaching above USD 4,150 per ounce. The rally has been fueled by growing safe-haven demand, amid escalating U.S.–China tensions—particularly over new tariff measures and technology export restrictions that revived fears of a trade and geopolitical slowdown. Combined with expectations of prolonged U.S. rate cuts and strong central bank buying, these factors have kept pushing gold to its all-time high.

Gold Price

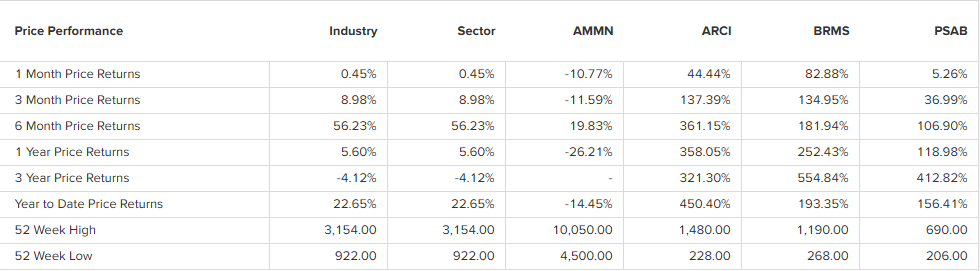

In line with this, gold-related stocks have also surged sharply, as reflected in the table, with names like ARCI (+450%), BRMS (+193%), and PSAB (+156%) YTD posting extraordinary gains. The broader industry and sector averages have also recorded solid double-digit year-to-date returns, showing strong investor enthusiasm toward mining and precious metal plays. However, AMMN has notably lagged behind its peers, recording a -14% decline year-to-date, suggesting that despite the broader sector’s bullish momentum, company-specific factors and profit-taking pressures may have weighed on its recent performance.

Gold Stock Performances

Given its recent underperformance compared to other gold miners, AMMN’s lagging position could actually present an attractive investment opportunity. In market cycles, lagging stocks within a strong sector often represent potential catch-up plays, as investors eventually rotate into undervalued or underpriced names once leading stocks have already priced in most of the optimism.

With gold prices at record highs and broad sector momentum remaining strong, AMMN’s relative weakness may reflect temporary sentiment or valuation adjustments rather than fundamental deterioration.

In contrast, the LQ45 index — dominated by established blue chips — lagged behind, suggesting that investors have been increasingly shifting toward diversified growth stories beyond traditional market leaders. Overall, the data underline JCI’s strong resilience and broad-based participation in the current market rally.

JCI and LQ45 Performance

Gold price has been soaring to record highs, reaching above USD 4,150 per ounce. The rally has been fueled by growing safe-haven demand, amid escalating U.S.–China tensions—particularly over new tariff measures and technology export restrictions that revived fears of a trade and geopolitical slowdown. Combined with expectations of prolonged U.S. rate cuts and strong central bank buying, these factors have kept pushing gold to its all-time high.

Gold Price

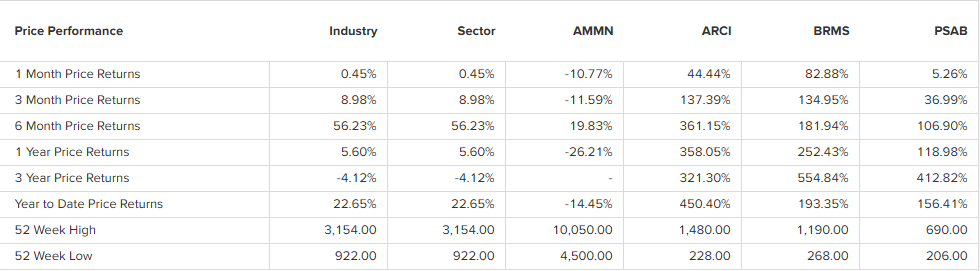

In line with this, gold-related stocks have also surged sharply, as reflected in the table, with names like ARCI (+450%), BRMS (+193%), and PSAB (+156%) YTD posting extraordinary gains. The broader industry and sector averages have also recorded solid double-digit year-to-date returns, showing strong investor enthusiasm toward mining and precious metal plays. However, AMMN has notably lagged behind its peers, recording a -14% decline year-to-date, suggesting that despite the broader sector’s bullish momentum, company-specific factors and profit-taking pressures may have weighed on its recent performance.

Gold Stock Performances

Given its recent underperformance compared to other gold miners, AMMN’s lagging position could actually present an attractive investment opportunity. In market cycles, lagging stocks within a strong sector often represent potential catch-up plays, as investors eventually rotate into undervalued or underpriced names once leading stocks have already priced in most of the optimism.

With gold prices at record highs and broad sector momentum remaining strong, AMMN’s relative weakness may reflect temporary sentiment or valuation adjustments rather than fundamental deterioration.

Written by Boris, the Broker

Comments