22 February 2026

Trump Global Tariff Announcement

Market Commentary

0 comments

US President Donald Trump announced a flat 15% global tariff, replacing the previously cancelled emergency measure by the Supreme Court of the United States. The policy will be effective for up to 150 days, providing a clearer framework compared to prior uncertainty surrounding higher and selective tariff proposals.

This development is viewed positively by the market as it comes in at a predictable, uniform rate amid earlier worst-case expectations of more aggressive measures. A flat 15% tariff reduces the risk of targeted trade escalation and lowers the uncertainty premium that had weighed on global risk assets, with policy clarity acting as a stabilizing factor for investor sentiment.

For emerging markets, including Indonesia, the flat structure mitigates the risk of disproportionate impact. The absence of country-specific penalties supports trade visibility and reduces the probability of abrupt capital outflows. Risk appetite is expected to improve, particularly across cyclical and commodity-linked sectors.

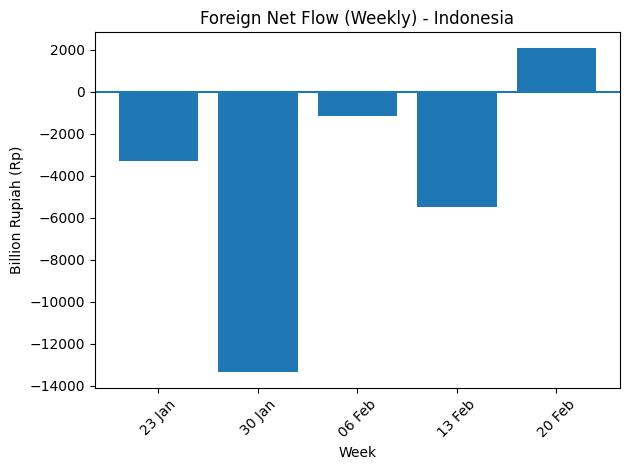

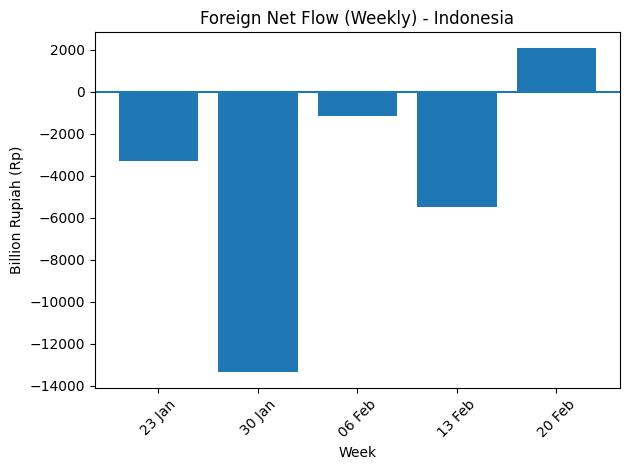

We see this as a constructive near-term catalyst for equities, with potential for relief rally continuation as positioning normalizes. With foreign inflows beginning to re-emerge in the domestic market, the clarification of the 15% global tariff further reinforces a strengthening risk-on bias. While monitoring further policy developments remains important, the current announcement provides a supportive backdrop for maintaining a constructive stance on risk assets.

This development is viewed positively by the market as it comes in at a predictable, uniform rate amid earlier worst-case expectations of more aggressive measures. A flat 15% tariff reduces the risk of targeted trade escalation and lowers the uncertainty premium that had weighed on global risk assets, with policy clarity acting as a stabilizing factor for investor sentiment.

For emerging markets, including Indonesia, the flat structure mitigates the risk of disproportionate impact. The absence of country-specific penalties supports trade visibility and reduces the probability of abrupt capital outflows. Risk appetite is expected to improve, particularly across cyclical and commodity-linked sectors.

We see this as a constructive near-term catalyst for equities, with potential for relief rally continuation as positioning normalizes. With foreign inflows beginning to re-emerge in the domestic market, the clarification of the 15% global tariff further reinforces a strengthening risk-on bias. While monitoring further policy developments remains important, the current announcement provides a supportive backdrop for maintaining a constructive stance on risk assets.

Written by Boris, the Broker

Comments