05 May 2025

Busy Roads Bring Profits

Market Commentary

0 comments

Who doesn’t love a long weekend?

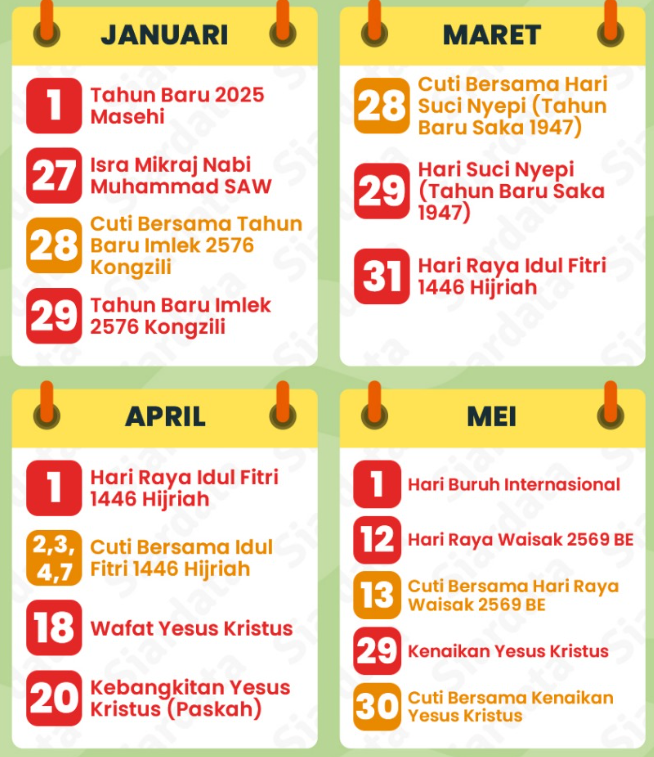

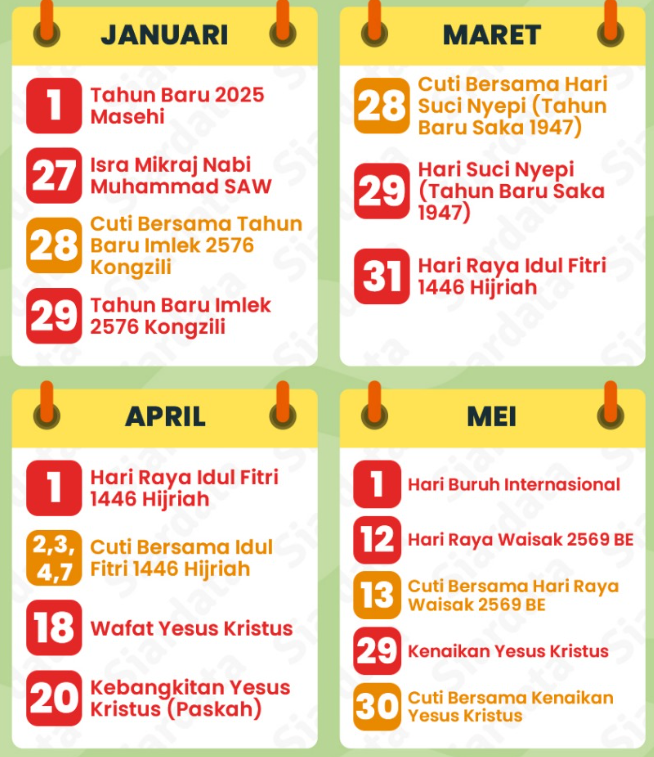

In 1Q25, it feels like we’ve been blessed with frequent long weekends thanks to joint leave days, sometimes Thursday-Friday, sometimes Monday-Tuesday, but either way, plenty of chances to escape the daily grind for a bit.

But let’s be real: usually, the time isn’t long enough for an overseas trip, so most of us end up traveling within the city or, at most, going out of town, and of course, by car.

With that in mind, it’s no surprise that toll road revenues jumped in 1Q25.

Just imagine: on weekends we use toll roads for leisure trips, and on weekdays we still use them to commute to work.

So basically, the toll roads are cashing in twice from our wallets.

Sometimes while driving, don’t you catch yourself thinking, “Wait, why is my e-toll balance draining so fast?”

Well, no wonder! It turns out JSMR is adjusting toll rates for 16 of its 31 roads in 2025.

So it’s not just that we’re driving more, but the drives themselves are getting pricier. The toll roads are busier, and our wallets are busier too, topping up e-toll balances here and there.

Just imagine, in 1Q25 alone, three toll roads already raised their rates:

Manado-Bitung by 11.4%, Bogor Outer Ring Road by 5.1%, and Semarang ABC by 4.8%.

Personally, I most often use the Bogor Outer Ring Road, so no wonder every time I check my e-toll balance, it feels like it’s vanishing faster!

If we connect the dots, all this talk about long weekends, quickly draining e-toll balances, and rising toll rates ultimately ties back to JSMR’s financial report.

How could it not? In 1Q25, JSMR posted a net profit of IDR 927 bn, up 49% yoy!

But interestingly, it wasn’t just higher toll revenue driving profit.

Another key factor was a 22% drop in finance costs, thanks to reduced debt after JTT repayments at the end of 2024.

Plus, their tax expenses were lower, giving even more breathing room on the bottom line.

In terms of margins, JSMR has done a solid job maintaining performance, with its EBITDA margin holding steady at 66%.

Their core profit is projected to grow 5% yoy in 2025 to IDR 3.9 tn, supported by tariff adjustments and stable margins.

Looking ahead to 2026, core profit is expected to climb even higher, up 14% yoy to IDR 4.4 tn, driven by annual tariff hikes, increased traffic volume from new toll roads, and lower interest expenses as interest rates trend downward.

So next time you’re driving through a toll road and grumbling, “Ugh, why is this so expensive now?” just remember, behind it all, JSMR is working hard to keep its business thriving.

No wonder analysts are still giving it a BUY recommendation with a target price of Rp7,000.

In other words, even if your wallet feels the squeeze from constantly topping up e-toll balances, for those holding JSMR shares, there’s a good chance you’ll be smiling at the end of the journey.

In 1Q25, it feels like we’ve been blessed with frequent long weekends thanks to joint leave days, sometimes Thursday-Friday, sometimes Monday-Tuesday, but either way, plenty of chances to escape the daily grind for a bit.

But let’s be real: usually, the time isn’t long enough for an overseas trip, so most of us end up traveling within the city or, at most, going out of town, and of course, by car.

With that in mind, it’s no surprise that toll road revenues jumped in 1Q25.

Just imagine: on weekends we use toll roads for leisure trips, and on weekdays we still use them to commute to work.

So basically, the toll roads are cashing in twice from our wallets.

Sometimes while driving, don’t you catch yourself thinking, “Wait, why is my e-toll balance draining so fast?”

Well, no wonder! It turns out JSMR is adjusting toll rates for 16 of its 31 roads in 2025.

So it’s not just that we’re driving more, but the drives themselves are getting pricier. The toll roads are busier, and our wallets are busier too, topping up e-toll balances here and there.

Just imagine, in 1Q25 alone, three toll roads already raised their rates:

Manado-Bitung by 11.4%, Bogor Outer Ring Road by 5.1%, and Semarang ABC by 4.8%.

Personally, I most often use the Bogor Outer Ring Road, so no wonder every time I check my e-toll balance, it feels like it’s vanishing faster!

If we connect the dots, all this talk about long weekends, quickly draining e-toll balances, and rising toll rates ultimately ties back to JSMR’s financial report.

How could it not? In 1Q25, JSMR posted a net profit of IDR 927 bn, up 49% yoy!

But interestingly, it wasn’t just higher toll revenue driving profit.

Another key factor was a 22% drop in finance costs, thanks to reduced debt after JTT repayments at the end of 2024.

Plus, their tax expenses were lower, giving even more breathing room on the bottom line.

In terms of margins, JSMR has done a solid job maintaining performance, with its EBITDA margin holding steady at 66%.

Their core profit is projected to grow 5% yoy in 2025 to IDR 3.9 tn, supported by tariff adjustments and stable margins.

Looking ahead to 2026, core profit is expected to climb even higher, up 14% yoy to IDR 4.4 tn, driven by annual tariff hikes, increased traffic volume from new toll roads, and lower interest expenses as interest rates trend downward.

So next time you’re driving through a toll road and grumbling, “Ugh, why is this so expensive now?” just remember, behind it all, JSMR is working hard to keep its business thriving.

No wonder analysts are still giving it a BUY recommendation with a target price of Rp7,000.

In other words, even if your wallet feels the squeeze from constantly topping up e-toll balances, for those holding JSMR shares, there’s a good chance you’ll be smiling at the end of the journey.

Written by Boris, the Broker

Comments