28 November 2024

Diminishing Risks Bring Renewed Confidence

Market Commentary

0 comments

"Indonesia is rich, not just in its natural resources, but also in its potential." We’ve often heard this saying, and it turns out to be more than just words.

Minister of Energy and Mineral Resources, recently revealed an astonishing fact: Indonesia's nickel reserves account for 42% of the global total.

Imagine, almost half the world depends on our nickel!

This is undoubtedly great news for the mining sector, especially for a major player like NCKL. They recently released their 3Q24 financial report.

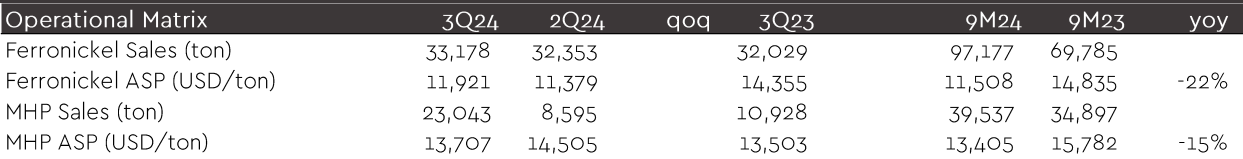

Their revenue hit IDR 2.0 tn, up 18% yoy, driven by a 103% yoy surge in limonite ore sales. And that’s not all, HPAL revenue also grew significantly, jumping 55% yoy to IDR 0.7 tn, with sales volume skyrocketing by 168% qoq.

Total revenue reached IDR 20.4 tn, up 18% yoy in 9M24, while net profit climbed to IDR 4.8 tn, an 8% yoy increase.

These figures not only exceeded analysts' expectations but also came close to market targets, with net profit achieving 91% of the annual projection, an impressive achievement!

One standout highlight was the debut of Electrolyte Cobalt (EC) in 3Q24. The first batch of 180 tons immediately stole the show, thanks to its outstanding cash margin of USD 22,000/ton, much higher than NCKL’s other refinery products.

For comparison, ferronickel generates a cash margin of only USD 3,100/ton, while MHP offers USD 7,500/ton.

Even though ferronickel and MHP prices dropped by 15% and 22%, respectively, in 9M24.

Operational efficiencies, such as short transport distances and competitive electricity costs, keeping cash margins stable. Despite these challenges, the company’s net margin remains strong at 24%, down only slightly from 26% last year.

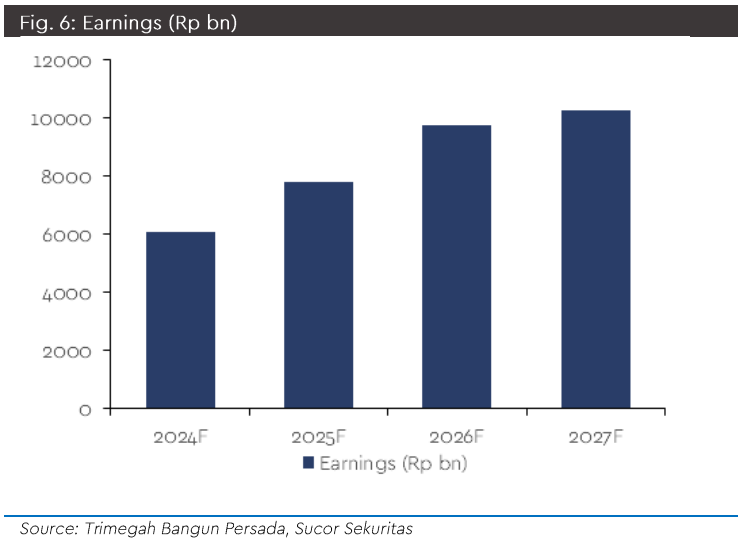

Given the extraordinary performance in 3Q24, our analysts have revised NCKL’s sales and net profit forecasts to more optimistic levels.

First, limonite ore sales, the main growth driver, are now projected to exceed initial assumptions. For 2024, sales volume has been revised up to 13 mn wmt, a 20% increase from the previous projection.

This figure is expected to rise further to 15 mn wmt in 2025, a 15% increase. Additionally, contributions from joint ventures like KPS and ONC are expected to become more significant. JV revenue is projected to reach IDR 2.7 tn in 2025, up 17% from the previous estimate.

Net profit for 2024 has been revised upward to IDR 6.7 tn, 6% higher than the initial assumption. For 2025, net profit is projected to reach IDR 8.1 tn, a 3% increase from earlier projections.

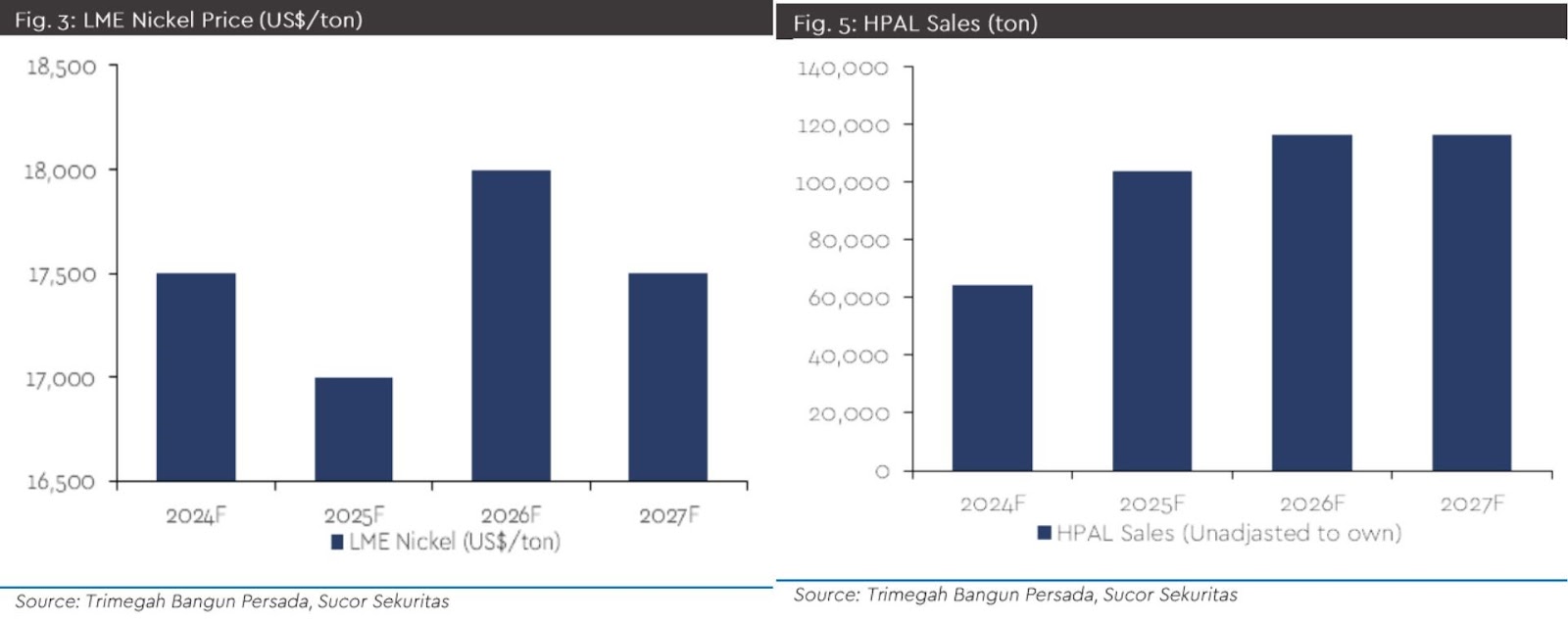

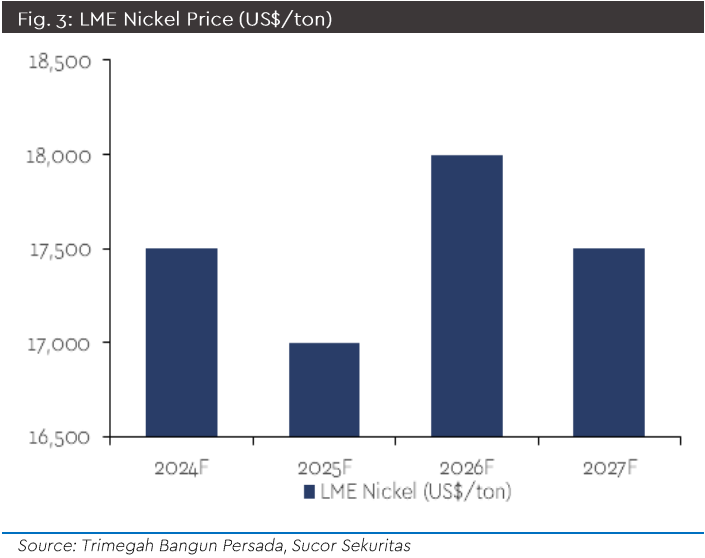

We remain optimistic about NCKL, as the downside risk to nickel prices is low.

At USD 15,900/ton, current prices are already at 60% of the cost curve. While the market is predicted to be in surplus in 2024-2025, potential supply cuts, since 40% of suppliers are operating at a loss.

With solid fundamentals and upward revisions to performance targets, NCKL remains an attractive stock to accumulate.

Therefore, we recommend a BUY with a target price of IDR 1,220.

Minister of Energy and Mineral Resources, recently revealed an astonishing fact: Indonesia's nickel reserves account for 42% of the global total.

Imagine, almost half the world depends on our nickel!

This is undoubtedly great news for the mining sector, especially for a major player like NCKL. They recently released their 3Q24 financial report.

Their revenue hit IDR 2.0 tn, up 18% yoy, driven by a 103% yoy surge in limonite ore sales. And that’s not all, HPAL revenue also grew significantly, jumping 55% yoy to IDR 0.7 tn, with sales volume skyrocketing by 168% qoq.

Total revenue reached IDR 20.4 tn, up 18% yoy in 9M24, while net profit climbed to IDR 4.8 tn, an 8% yoy increase.

These figures not only exceeded analysts' expectations but also came close to market targets, with net profit achieving 91% of the annual projection, an impressive achievement!

One standout highlight was the debut of Electrolyte Cobalt (EC) in 3Q24. The first batch of 180 tons immediately stole the show, thanks to its outstanding cash margin of USD 22,000/ton, much higher than NCKL’s other refinery products.

For comparison, ferronickel generates a cash margin of only USD 3,100/ton, while MHP offers USD 7,500/ton.

Even though ferronickel and MHP prices dropped by 15% and 22%, respectively, in 9M24.

Operational efficiencies, such as short transport distances and competitive electricity costs, keeping cash margins stable. Despite these challenges, the company’s net margin remains strong at 24%, down only slightly from 26% last year.

Given the extraordinary performance in 3Q24, our analysts have revised NCKL’s sales and net profit forecasts to more optimistic levels.

First, limonite ore sales, the main growth driver, are now projected to exceed initial assumptions. For 2024, sales volume has been revised up to 13 mn wmt, a 20% increase from the previous projection.

This figure is expected to rise further to 15 mn wmt in 2025, a 15% increase. Additionally, contributions from joint ventures like KPS and ONC are expected to become more significant. JV revenue is projected to reach IDR 2.7 tn in 2025, up 17% from the previous estimate.

Net profit for 2024 has been revised upward to IDR 6.7 tn, 6% higher than the initial assumption. For 2025, net profit is projected to reach IDR 8.1 tn, a 3% increase from earlier projections.

We remain optimistic about NCKL, as the downside risk to nickel prices is low.

At USD 15,900/ton, current prices are already at 60% of the cost curve. While the market is predicted to be in surplus in 2024-2025, potential supply cuts, since 40% of suppliers are operating at a loss.

With solid fundamentals and upward revisions to performance targets, NCKL remains an attractive stock to accumulate.

Therefore, we recommend a BUY with a target price of IDR 1,220.

Written by Boris, the Broker

Comments