18 November 2024

High Stakes, Low Returns: Gambling's Economic Trap

Market Commentary

0 comments

Have you ever wondered what it feels like to just want some affordable entertainment, but end up stuck on illegal streaming sites like Idlix?

Honestly, many middle to lower income people in Indonesia prefer watching free content there rather than paying for subscriptions on official platforms like Netflix or Disney+ Hotstar.

But instead of getting smooth entertainment, they're bombarded with non-stop ads for online gambling.

Imagine, the sign-up process is super easy, no need for a bank account, just e-wallets like OVO or DANA, and with only IDR 10,000, you're already in the game!

It's no surprise that the number of online gamblers in Indonesia keeps skyrocketing year after year.

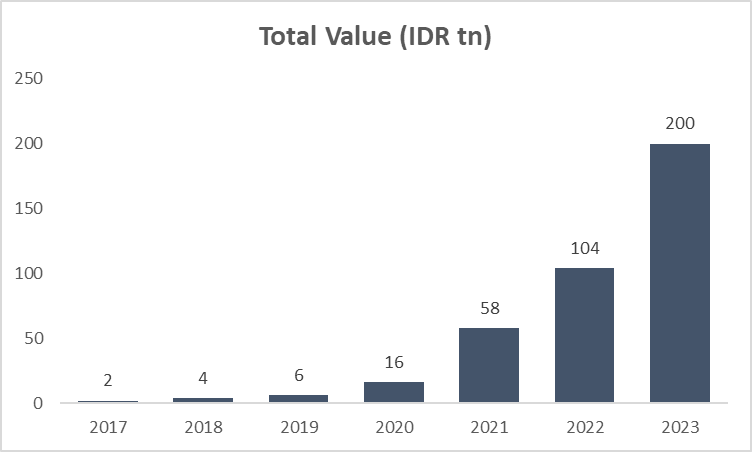

The numbers are staggering: transactions that were once around 250,000 are now exploding to 236 mn transactions over the past six years, with the total value reaching a whopping IDR 200 tn!

This is exponential growth on a mind-blowing scale. Government data even shows that there are 2.7 mn Indonesians involved in online gambling.

Out of this, around 2.1 mn people earn just IDR 3 mn/month, including students and housewives.

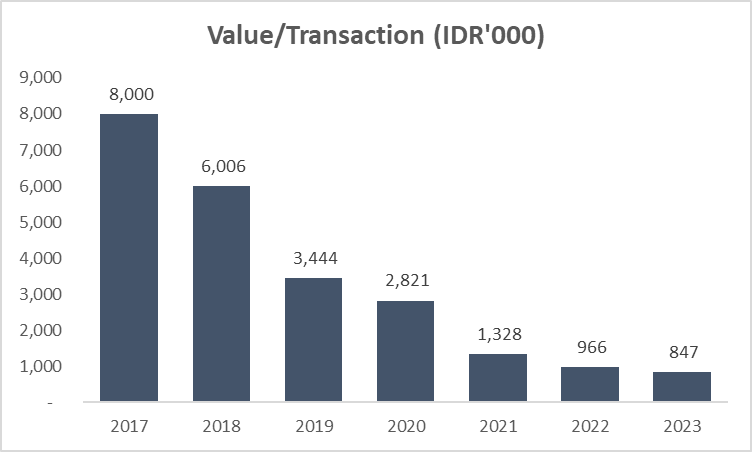

Interestingly, while the total value of gambling transactions is rising, the average transaction value per person has significantly dropped.

Back in 2017, a single transaction could average IDR 8 mn, but in 2023, it's now down to just IDR 0.8 mn.

What does that mean?

It indicates that more low income individuals are getting involved, not for fun, but as a desperate attempt to survive amidst increasing economic pressure, from rising inflation to higher living costs and job uncertainty.

This trend paints a new picture: online gambling has turned into a kind of "shortcut" for those hoping to change their luck with a minimal budget.

The continuous stream of ads on illegal streaming sites makes it so accessible, even for those who only have IDR 10,000 left in their wallets.

No wonder more people are tempted to join, because who wouldn’t want to win big with just a small stake?

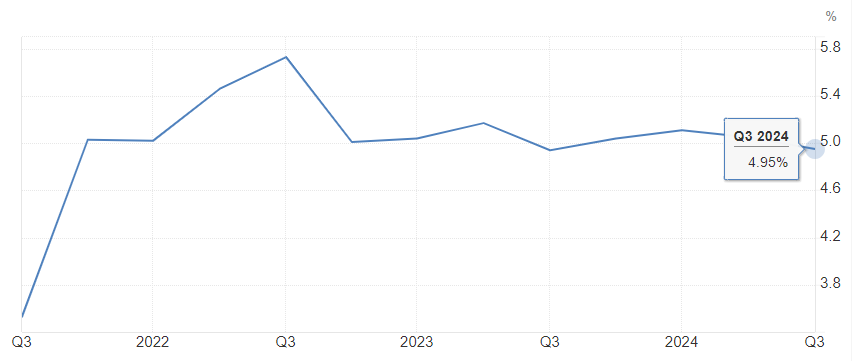

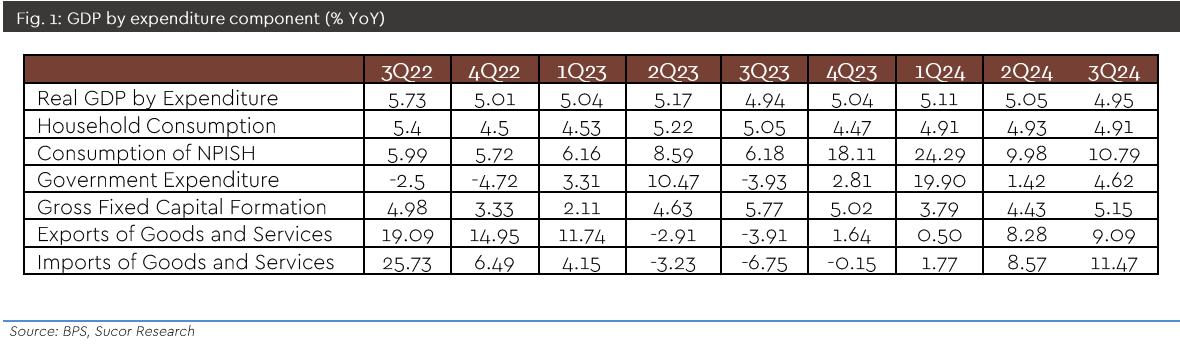

This could also explain why Indonesia's economic growth slightly slowed in 3Q24, with a growth rate of 4.95% yoy, down a bit from 5.05% in 2Q24.

Sure, qoq growth is still at 1.50%, but the main concern here is household spending.

Just imagine, for three consecutive quarters, household expenditure growth couldn’t break past the 5.0% mark.

In this quarter, it even dipped slightly to 4.91% from 4.93%.

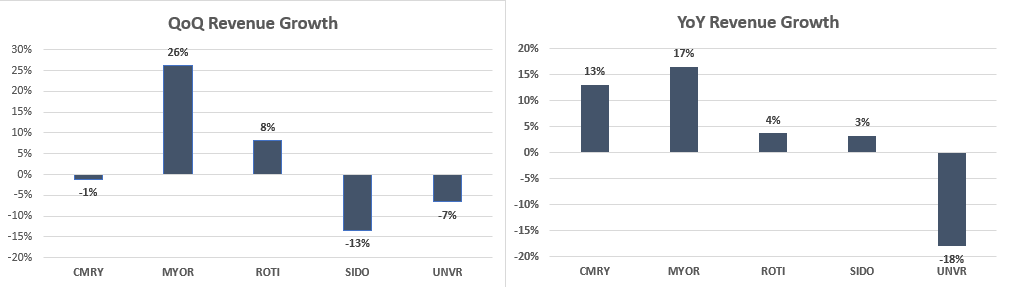

And yes, this may also shed light on why the consumer sector's revenue in 3Q24 mostly declined. Many major players are struggling to maintain demand due to weakening purchasing power.

However, just take a look, only MYOR, INDF, and ICBP managed to post qoq growth in 3Q24.

.png)

But what's different is that MYOR has shown consistent growth from 1Q24 through to now!

The numbers in 3Q24 reveal something intriguing. While most consumer companies are struggling, Mayora shines with a revenue surge of 26% qoq and double digit yoy growth.

Their sales have now hit IDR 25.64 tn!

So, even with sluggish consumer spending, Mayora continues to power through and grow.

They've proven themselves as one of the top players in the consumer sector with solid topline growth.

That’s why we maintain our BUY recommendation for MYOR with a target price of IDR 3,300.

Honestly, many middle to lower income people in Indonesia prefer watching free content there rather than paying for subscriptions on official platforms like Netflix or Disney+ Hotstar.

But instead of getting smooth entertainment, they're bombarded with non-stop ads for online gambling.

Imagine, the sign-up process is super easy, no need for a bank account, just e-wallets like OVO or DANA, and with only IDR 10,000, you're already in the game!

It's no surprise that the number of online gamblers in Indonesia keeps skyrocketing year after year.

The numbers are staggering: transactions that were once around 250,000 are now exploding to 236 mn transactions over the past six years, with the total value reaching a whopping IDR 200 tn!

This is exponential growth on a mind-blowing scale. Government data even shows that there are 2.7 mn Indonesians involved in online gambling.

Out of this, around 2.1 mn people earn just IDR 3 mn/month, including students and housewives.

Interestingly, while the total value of gambling transactions is rising, the average transaction value per person has significantly dropped.

Back in 2017, a single transaction could average IDR 8 mn, but in 2023, it's now down to just IDR 0.8 mn.

What does that mean?

It indicates that more low income individuals are getting involved, not for fun, but as a desperate attempt to survive amidst increasing economic pressure, from rising inflation to higher living costs and job uncertainty.

This trend paints a new picture: online gambling has turned into a kind of "shortcut" for those hoping to change their luck with a minimal budget.

The continuous stream of ads on illegal streaming sites makes it so accessible, even for those who only have IDR 10,000 left in their wallets.

No wonder more people are tempted to join, because who wouldn’t want to win big with just a small stake?

This could also explain why Indonesia's economic growth slightly slowed in 3Q24, with a growth rate of 4.95% yoy, down a bit from 5.05% in 2Q24.

Sure, qoq growth is still at 1.50%, but the main concern here is household spending.

Just imagine, for three consecutive quarters, household expenditure growth couldn’t break past the 5.0% mark.

In this quarter, it even dipped slightly to 4.91% from 4.93%.

And yes, this may also shed light on why the consumer sector's revenue in 3Q24 mostly declined. Many major players are struggling to maintain demand due to weakening purchasing power.

However, just take a look, only MYOR, INDF, and ICBP managed to post qoq growth in 3Q24.

.png)

But what's different is that MYOR has shown consistent growth from 1Q24 through to now!

The numbers in 3Q24 reveal something intriguing. While most consumer companies are struggling, Mayora shines with a revenue surge of 26% qoq and double digit yoy growth.

Their sales have now hit IDR 25.64 tn!

So, even with sluggish consumer spending, Mayora continues to power through and grow.

They've proven themselves as one of the top players in the consumer sector with solid topline growth.

That’s why we maintain our BUY recommendation for MYOR with a target price of IDR 3,300.

Written by Boris, the Broker

Comments