The commodity markets have just witnessed a staggering drama. In a span of just 36 hours, the "safe haven" status of precious metals was severely tested as over $7 trillion in market value evaporated. Gold plummeted below the $4,900 mark (down 13.6%), while Silver saw a violent 30% drawdown to below $85. This sudden "flash crash" has sent shockwaves through global portfolios, as Platinum and Palladium also dropped significantly by 27% and 21.5% respectively.

.png)

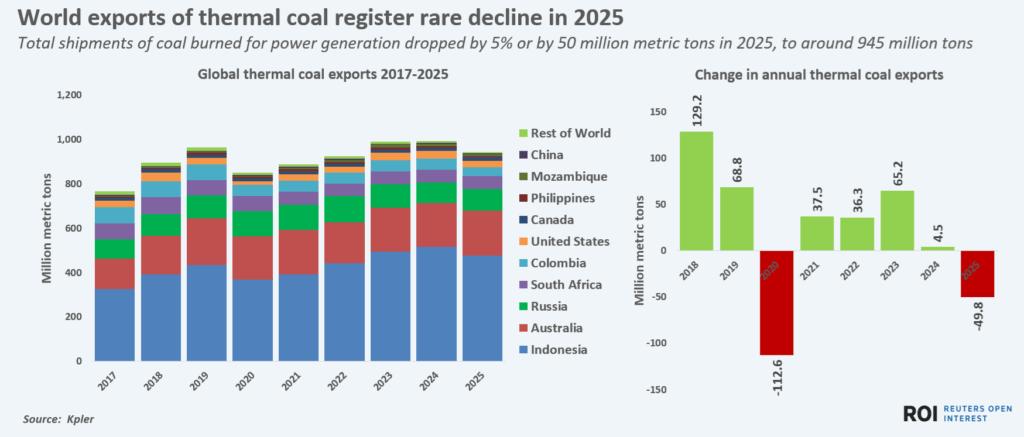

However, a different story is emerging in the energy sector. While metals crashed, Newcastle coal prices rose 6% to $118.15 last Friday. This rally is backed by tight supply; global thermal coal exports already saw a rare decline to 945 million tons in 2025. Now, the Indonesian government’s plan to slash production by 155 million tons in 2026 is set to create an even deeper supply crunch.

This 155 million ton cut represents a massive 17% hole in the total global supply. If demand remains steady, removing nearly a fifth of the world’s export capacity will act as a powerful catalyst for a price surge. We are looking at a classic supply-demand squeeze where scarcity becomes the primary driver for the next bull run, making coal the strategic "pivot" for investors moving away from volatile precious metals.

To capture this opportunity, our top conviction pick is Adaro Andalan Indonesia (AADI). AADI stands out for its high-quality asset base and a rare "deep value" profile, trading at an attractively low P/E ratio while offering a high dividend yield. Backed by stellar company management, the company is perfectly positioned to capitalize on the upcoming 17% global supply deficit. AADI remains our preferred vehicle for investors looking to transform current market volatility into a long-term strategic advantage.