10 November 2024

Laying the Groundwork

Market Commentary

0 comments

Amid Indonesia's ambitious drive to fulfill its housing needs, BTN, in collaboration with relevant ministries, recently held a strategic discussion to advance the 3 Million Homes Program.

In a forum buzzing with hundreds of developers, government officials, and BTN leaders, concrete solutions were laid out to tackle the biggest challenges in delivering housing for the people.

But this program is more than just about building houses.

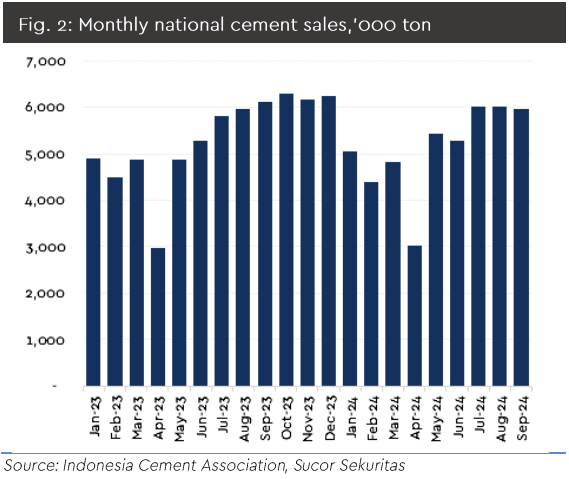

Beyond that, it has the potential to drive substantial economic impact, including boosting supporting industries like cement production.

Imagine this: if each 36 sqm home requires approximately 3 tons of cement, then building just 2 mn homes would require an additional 6 mn tons of cement.

Here lies a golden opportunity. According to our analysis, one of the key beneficiaries poised to gain significant profits is INTP.

With its strong distribution network and large production capacity, INTP is perfectly positioned to capture this surge in demand, reinforcing its role as a leader in the national cement industry.

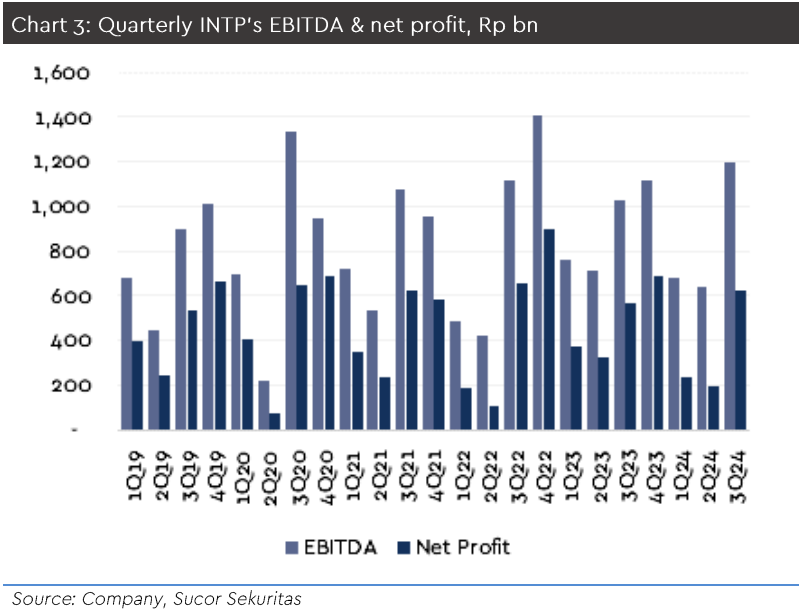

INTP’s impressive ability to secure substantial profits amidst industry challenges showcases the strength of its business strategy.

This is evident from its 3Q24 financial results, where INTP reported a profit of IDR 621 bn, reflecting a 9.3% yoy increase and a remarkable 215.9% jump qoq.

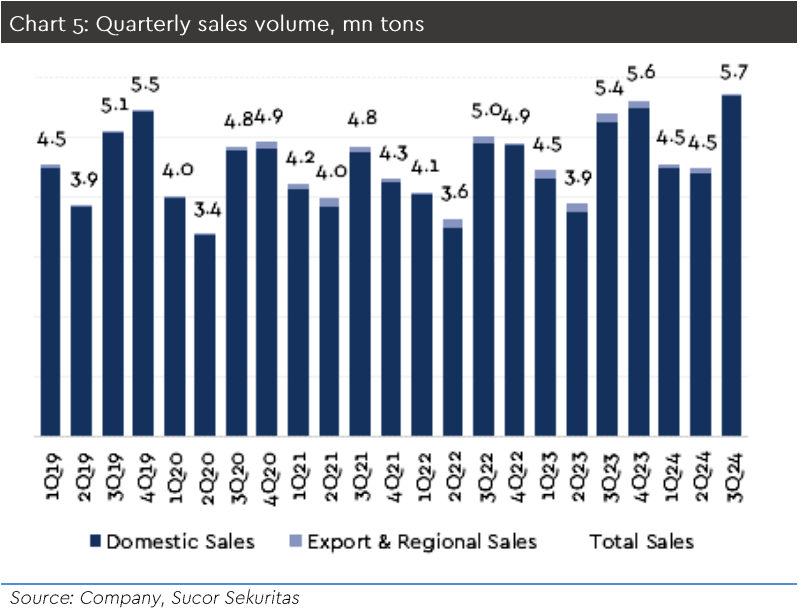

This impressive growth was driven by an 8.6% yoy increase in sales volume, demonstrating strong market demand, particularly from the property and infrastructure sectors.

What's intriguing is that INTP achieved this despite a 2.2% yoy decline in ASP.

This proves that INTP's strategy of cost efficiency and distribution optimization successfully boosted profitability, even under price pressures.

INTP's growth momentum isn’t just visible in 3Q24, it extends throughout 9M24, where sales volume rose by 7.3% yoy.

A key driver behind this growth is the strong surge in domestic sales, which jumped by 9.4% yoy, supported by additional contributions from the newly integrated Grobogan plant.

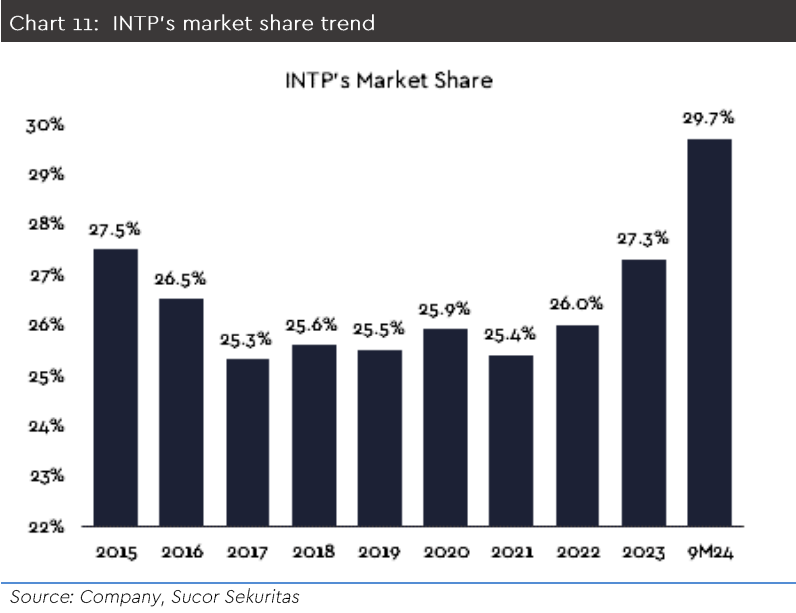

This growth is not just about higher volumes but also an expanding market share.

In 9M24, INTP successfully increased its market share to 29.7%, a significant rise from 27.6% during the same period last year.

This growth solidifies INTP's position as the leader in Indonesia's cement industry, especially with its strategy focused on more profitable segments.

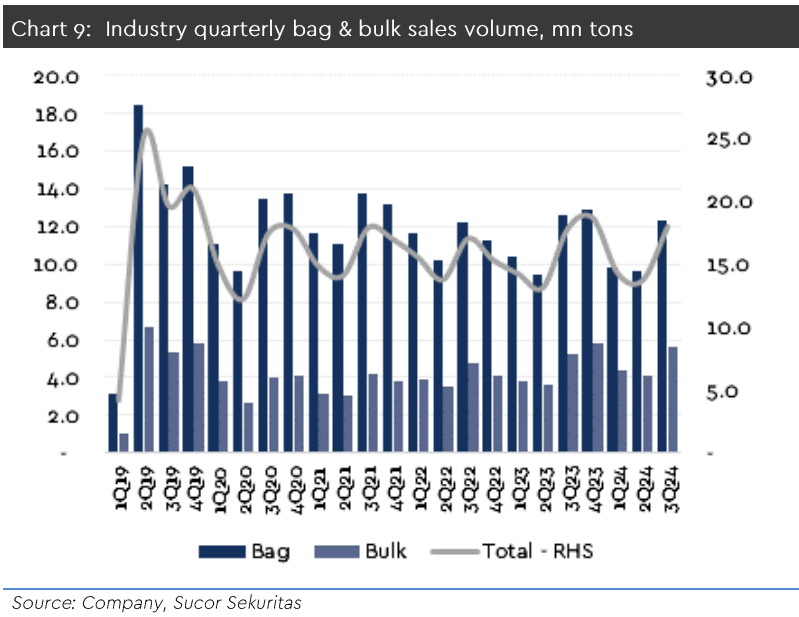

Even more impressive is the surge in bulk cement sales, which soared by 32.6% yoy, significantly outpacing the modest 1.4% yoy increase in bagged cement sales.

The high demand for bulk cement is driven by the surge in infrastructure projects, such as the MRT, LRT, and toll road projects.

Additionally, the rise in commercial projects in the Greater Jakarta area, including warehouses, factories, and new housing developments, has further boosted INTP’s bulk cement sales.

With this momentum, INTP is in a prime position to continue capitalizing on Indonesia's construction boom.

The presence of the Grobogan plant not only strengthens INTP’s production capacity but also enhances distribution efficiency, allowing the company to respond swiftly to rising demand.

As the Three Million Homes Program and other infrastructure projects progress, INTP is set to remain a dominant player, well-positioned to capture future growth opportunities.

Given the strong momentum in 3Q24, we believe this positive trend will continue into 1Q24.

Historically, cement sales volumes tend to rise in 4Q, driven by a rush to complete construction projects before year-end.

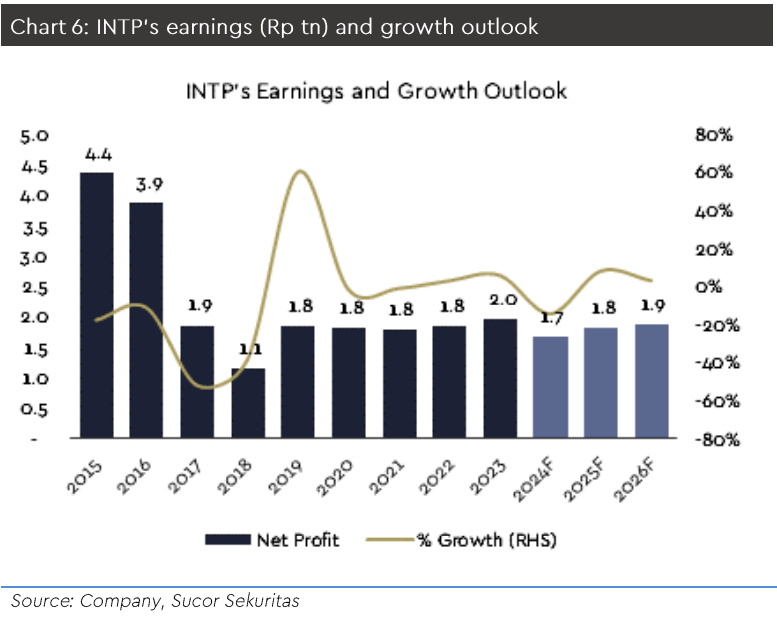

Therefore, we project INTP’s profit in 4Q24 to reach IDR 614 bn, underpinned by an estimated 4.3% yoy growth in sales volume, with ASP expected to remain stable.

This stability is further supported by cost efficiency, particularly on the financing side, after INTP repaid several maturing loans, ultimately helping to maintain a steady NPM at 12%.

Looking ahead, we project INTP will continue to post moderate profit growth, with a CAGR of around 5% per year over the next three years.

This growth will be driven by a management strategy focused on conservatively increasing sales volume by 1.8% annually.

Additionally, reduced interest expenses from debt repayment and operational efficiencies will be key in sustaining stable profitability.

We maintain our BUY recommendation with a target price of IDR 7,600.

Source: Liputan6

In a forum buzzing with hundreds of developers, government officials, and BTN leaders, concrete solutions were laid out to tackle the biggest challenges in delivering housing for the people.

But this program is more than just about building houses.

Beyond that, it has the potential to drive substantial economic impact, including boosting supporting industries like cement production.

Imagine this: if each 36 sqm home requires approximately 3 tons of cement, then building just 2 mn homes would require an additional 6 mn tons of cement.

Here lies a golden opportunity. According to our analysis, one of the key beneficiaries poised to gain significant profits is INTP.

With its strong distribution network and large production capacity, INTP is perfectly positioned to capture this surge in demand, reinforcing its role as a leader in the national cement industry.

INTP’s impressive ability to secure substantial profits amidst industry challenges showcases the strength of its business strategy.

This is evident from its 3Q24 financial results, where INTP reported a profit of IDR 621 bn, reflecting a 9.3% yoy increase and a remarkable 215.9% jump qoq.

This impressive growth was driven by an 8.6% yoy increase in sales volume, demonstrating strong market demand, particularly from the property and infrastructure sectors.

What's intriguing is that INTP achieved this despite a 2.2% yoy decline in ASP.

This proves that INTP's strategy of cost efficiency and distribution optimization successfully boosted profitability, even under price pressures.

INTP's growth momentum isn’t just visible in 3Q24, it extends throughout 9M24, where sales volume rose by 7.3% yoy.

A key driver behind this growth is the strong surge in domestic sales, which jumped by 9.4% yoy, supported by additional contributions from the newly integrated Grobogan plant.

This growth is not just about higher volumes but also an expanding market share.

In 9M24, INTP successfully increased its market share to 29.7%, a significant rise from 27.6% during the same period last year.

This growth solidifies INTP's position as the leader in Indonesia's cement industry, especially with its strategy focused on more profitable segments.

Even more impressive is the surge in bulk cement sales, which soared by 32.6% yoy, significantly outpacing the modest 1.4% yoy increase in bagged cement sales.

The high demand for bulk cement is driven by the surge in infrastructure projects, such as the MRT, LRT, and toll road projects.

Additionally, the rise in commercial projects in the Greater Jakarta area, including warehouses, factories, and new housing developments, has further boosted INTP’s bulk cement sales.

With this momentum, INTP is in a prime position to continue capitalizing on Indonesia's construction boom.

The presence of the Grobogan plant not only strengthens INTP’s production capacity but also enhances distribution efficiency, allowing the company to respond swiftly to rising demand.

As the Three Million Homes Program and other infrastructure projects progress, INTP is set to remain a dominant player, well-positioned to capture future growth opportunities.

Given the strong momentum in 3Q24, we believe this positive trend will continue into 1Q24.

Historically, cement sales volumes tend to rise in 4Q, driven by a rush to complete construction projects before year-end.

Therefore, we project INTP’s profit in 4Q24 to reach IDR 614 bn, underpinned by an estimated 4.3% yoy growth in sales volume, with ASP expected to remain stable.

This stability is further supported by cost efficiency, particularly on the financing side, after INTP repaid several maturing loans, ultimately helping to maintain a steady NPM at 12%.

Looking ahead, we project INTP will continue to post moderate profit growth, with a CAGR of around 5% per year over the next three years.

This growth will be driven by a management strategy focused on conservatively increasing sales volume by 1.8% annually.

Additionally, reduced interest expenses from debt repayment and operational efficiencies will be key in sustaining stable profitability.

We maintain our BUY recommendation with a target price of IDR 7,600.

Written by Boris, the Broker

Comments