28 November 2024

Tough Quarter yet Undemanding Valuation

Market Commentary

0 comments

The Fed's recent hawkish tone reflects concerns over the resilience of the U.S. economy, highlighted by robust labor market conditions, persistent consumer spending, and sticky inflation. While the U.S. manufacturing PMI has shown contraction, other data, such as strong GDP growth in Q3 2024 and a slower-than-expected disinflation trend, suggest that demand remains robust.

.jpeg)

The Fed is wary that such economic strength could reignite inflationary pressures, particularly as wage growth and service-sector inflation remain elevated. This has led to signaling that rates may be higher for longer, which means unsupportive top-down for property sector.

On top of overal JCI's stocks weak performance, we find this contributes a significant role to recent dip of the property stock prices. Should this trend continues, it may discourage the growth of marketing sales of property companies as the mortgage rate is likely to remain high, resulting weaker sales which translates to weaker share price.

In 3Q24, SMRA reported weak marketing sales of IDR939bn, representing a 35% YoY and 13% QoQ decline. This performance was primarily due to the absence of new launches at Summarecon Bogor, which generated no sales in 3Q24 compared to IDR626bn in 3Q23. As a result, cumulative marketing sales for 9M24 reached IDR2.7tn, down 13% YoY, achieving only 53% of both our and management’s FY24 targets.

.jpeg)

Due to slower marketing sales, SMRA reported a weak net profit of IDR180bn in 3Q24, declining 15% YoY and 42% QoQ. This performance was primarily driven by a sharp decrease in development revenue recognition to Rp1.1 trillion, down 26% YoY and 61% QoQ, following a high base in previous quarters. Furthermore, general and administrative expenses increased significantly to IDR34bn, rose 29% YoY and 39% QoQ.

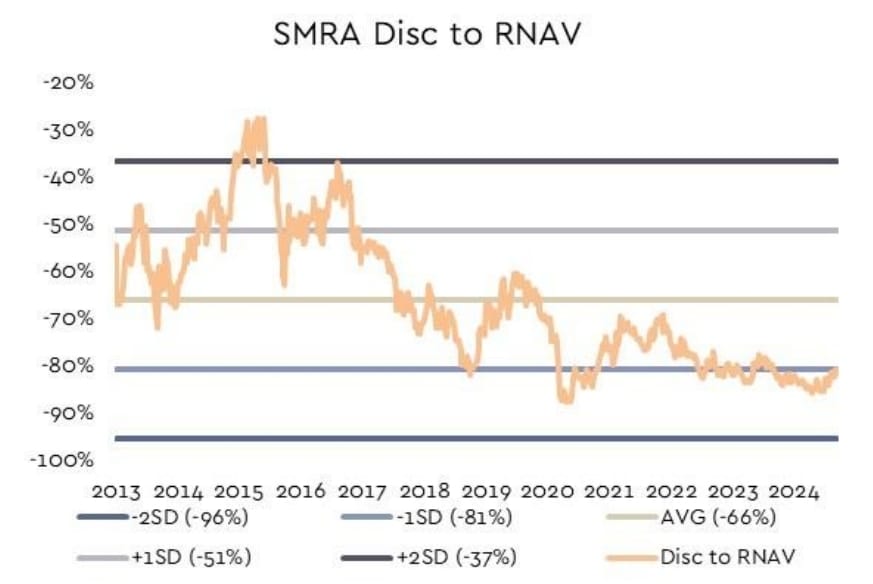

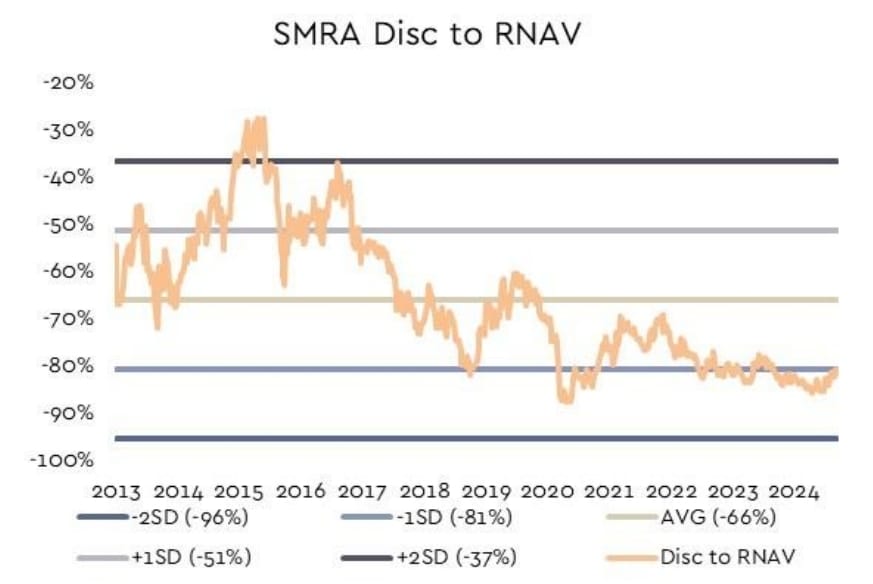

We remain cautious about SMRA's ability to bridge the gap and achieve its full-year target. However, we believe recent dip on its share price has made SMRA's valuation undemanding.

Other thing to consider is that SMRA's recurring income now contributes 40% of SMRA's total revenue, making it the second-largest among the Big 4 property developers, behind PWON's 75% contribution.

Therefore, we believe investor should pay attention towards overal market sentiment. Once the market starting to show recovery and inflows from foreign investor, SMRA is one stock that worth going long with a target price of Rp810, implying a 73% discount to RNAV and a 1.0x forward P/B.

.jpeg)

The Fed is wary that such economic strength could reignite inflationary pressures, particularly as wage growth and service-sector inflation remain elevated. This has led to signaling that rates may be higher for longer, which means unsupportive top-down for property sector.

On top of overal JCI's stocks weak performance, we find this contributes a significant role to recent dip of the property stock prices. Should this trend continues, it may discourage the growth of marketing sales of property companies as the mortgage rate is likely to remain high, resulting weaker sales which translates to weaker share price.

In 3Q24, SMRA reported weak marketing sales of IDR939bn, representing a 35% YoY and 13% QoQ decline. This performance was primarily due to the absence of new launches at Summarecon Bogor, which generated no sales in 3Q24 compared to IDR626bn in 3Q23. As a result, cumulative marketing sales for 9M24 reached IDR2.7tn, down 13% YoY, achieving only 53% of both our and management’s FY24 targets.

.jpeg)

Due to slower marketing sales, SMRA reported a weak net profit of IDR180bn in 3Q24, declining 15% YoY and 42% QoQ. This performance was primarily driven by a sharp decrease in development revenue recognition to Rp1.1 trillion, down 26% YoY and 61% QoQ, following a high base in previous quarters. Furthermore, general and administrative expenses increased significantly to IDR34bn, rose 29% YoY and 39% QoQ.

We remain cautious about SMRA's ability to bridge the gap and achieve its full-year target. However, we believe recent dip on its share price has made SMRA's valuation undemanding.

Other thing to consider is that SMRA's recurring income now contributes 40% of SMRA's total revenue, making it the second-largest among the Big 4 property developers, behind PWON's 75% contribution.

Therefore, we believe investor should pay attention towards overal market sentiment. Once the market starting to show recovery and inflows from foreign investor, SMRA is one stock that worth going long with a target price of Rp810, implying a 73% discount to RNAV and a 1.0x forward P/B.

Written by Boris, the Broker

Comments