16 September 2025

From Yellow Machines to Yellow Metal

Market Commentary

0 comments

United Tractors has long been synonymous with heavy equipment and coal. But today, UNTR is getting serious about another yellow metal: gold.

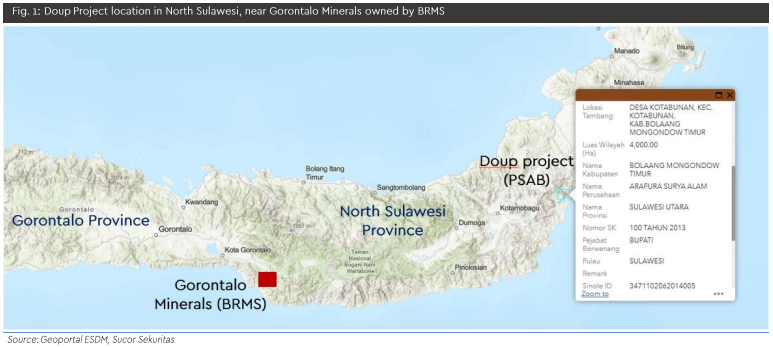

Imagine UNTR not just as a coal giant, but as a miner with a hidden golden engine. Its latest move, the acquisition of the Doup Project in North Sulawesi, marks a bold step into gold and could redefine the company’s growth trajectory.

Doup is no ordinary asset. With grades of 1.28 g/t and expected production of 140–155 koz per year, it has the potential to boost UNTR’s gold output by nearly 70% once fully operational in 2026. At today’s backdrop of high gold prices, this expansion could be truly transformative.

Run the math. At an average selling price of USD 3,700/oz and a cash cost of USD 1,900/oz, Doup could deliver an additional Rp2.8 trillion in net profit, equal to 13% of UNTR’s 2027F earnings. Gold will no longer be a side story — it is becoming a core growth driver.

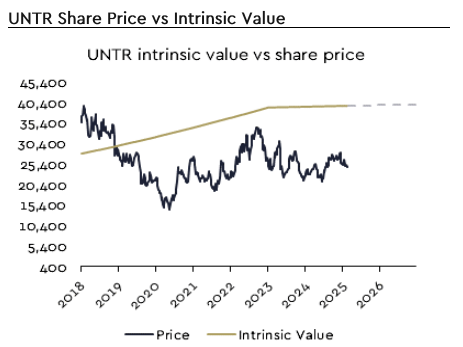

For investors, this changes the narrative. UNTR is trading at just 4.3x 2025F P/E with a dividend yield near 8%, backed by a net cash balance sheet. As the market begins to reprice UNTR’s gold story, valuation has plenty of room to re-rate. From a coal-heavy legacy to a diversified future, UNTR is doubling down on gold at just the right time.

Written by Boris, the Broker

Comments