12 September 2025

The Fever That Makes Gold Stronger

Market Commentary

0 comments

Lately, I’ve noticed many people around me getting sick because of unpredictable weather. Fever, flu, sore throat—conditions drop easily when the body loses balance. Turns out, it is not only people who can catch a cold, economies can too.

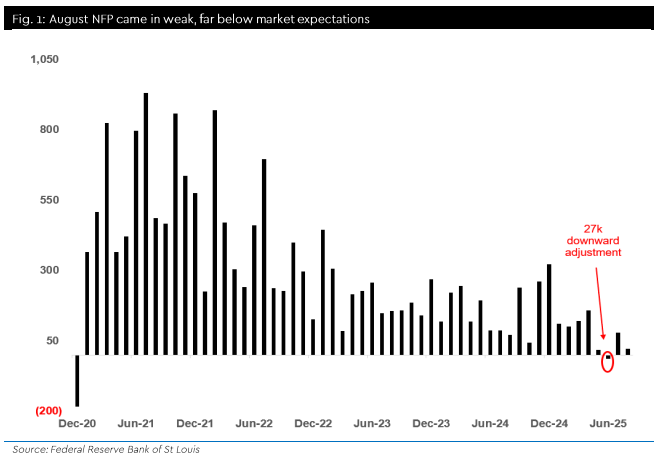

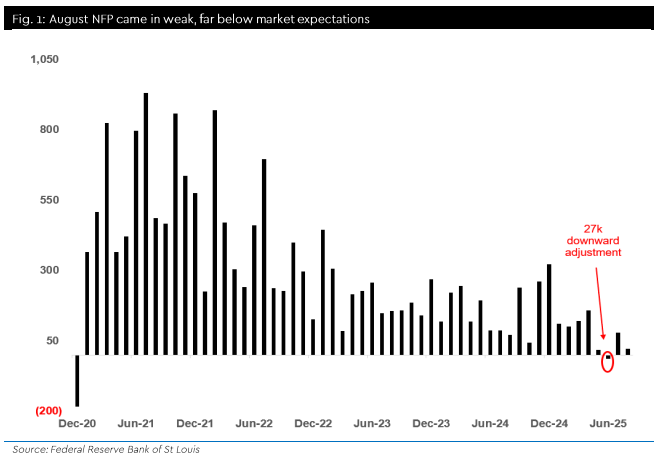

This week, the United States showed clear signs of fever after August payrolls came in at only +22k, far below expectations, with June even revised into negative territory. The unemployment rate climbed to 4.3 percent, sending a message that the world’s largest economy is running out of energy. For the market, that means one thing: the Fed has no choice but to prescribe a stronger dose of rate cuts.

Here comes the twist. The medicine for the U.S. economy works like vitamins for gold. Prices surged to a fresh record of USD 3,600/oz as investors rushed into safe havens. With the dollar weakening and Treasuries losing their shine, gold has become the star asset of 2025. It is already up nearly 40 percent YTD, and the rally could stretch further, especially with U.S. debt ballooning and fears of financial repression if Trump returns to power. Gold is no longer just glitter, it is protection.

.png)

At the same time, lower global rates ease the burden of debt service, which currently consumes about a quarter of government tax revenue. Beyond the macro story, the more immediate play lies in gold stocks. Names like INDY and BRMS stand to benefit from record bullion prices, offering investors not just shelter from America’s fever but also a way to capture upside momentum in the local market.

This week, the United States showed clear signs of fever after August payrolls came in at only +22k, far below expectations, with June even revised into negative territory. The unemployment rate climbed to 4.3 percent, sending a message that the world’s largest economy is running out of energy. For the market, that means one thing: the Fed has no choice but to prescribe a stronger dose of rate cuts.

Here comes the twist. The medicine for the U.S. economy works like vitamins for gold. Prices surged to a fresh record of USD 3,600/oz as investors rushed into safe havens. With the dollar weakening and Treasuries losing their shine, gold has become the star asset of 2025. It is already up nearly 40 percent YTD, and the rally could stretch further, especially with U.S. debt ballooning and fears of financial repression if Trump returns to power. Gold is no longer just glitter, it is protection.

Gold Price per 12 September 2025

For Indonesia, this global fever actually spells opportunity. As one of the world’s top gold producers with roughly 130 tons annually, every tick higher in prices directly boosts state revenues through royalties and taxes..png)

At the same time, lower global rates ease the burden of debt service, which currently consumes about a quarter of government tax revenue. Beyond the macro story, the more immediate play lies in gold stocks. Names like INDY and BRMS stand to benefit from record bullion prices, offering investors not just shelter from America’s fever but also a way to capture upside momentum in the local market.

Written by Boris, the Broker

Comments