09 September 2025

From Merger Costs to Synergy Gains

Market Commentary

0 comments

As we know, XL Axiata has merged with Smartfren, creating one of the largest telco players in Indonesia. This move is designed to deliver wider coverage, stronger resources, and major efficiency gains that could reshape the industry landscape.

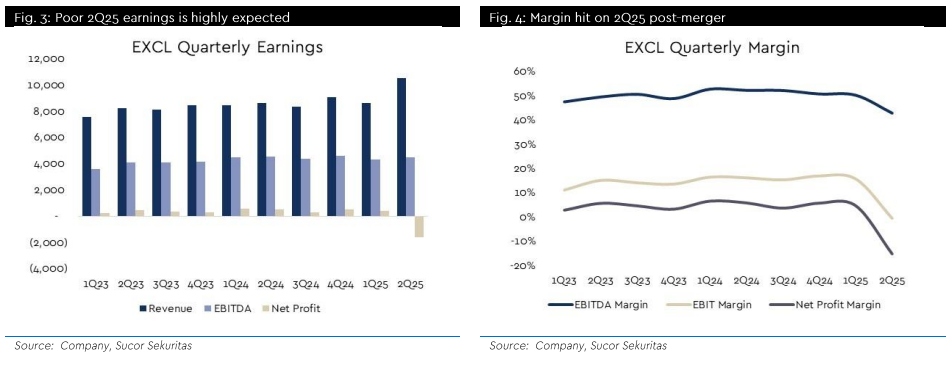

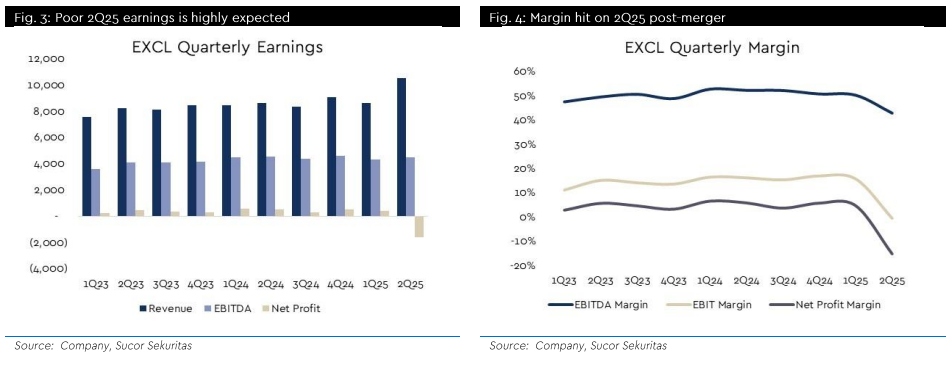

As expected, the transition comes with temporary costs. In 2Q25, EXCL reported a net loss of Rp1.6tn, largely from merger expenses and asset write-offs. This was not surprising given the scale of the integration. What matters more is that normalized EBITDA grew +10% yoy to Rp4.9tn, proving the core business remains solid through the transition.

The real excitement is in the synergy ahead. Management is targeting USD100–200mn in synergy value by 2025, potentially rising to USD300–400mn once integration is complete. Most of this will come from network efficiencies that lower costs and improve cash flow.

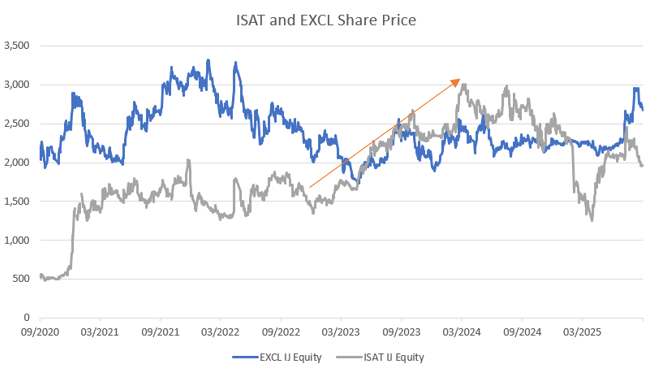

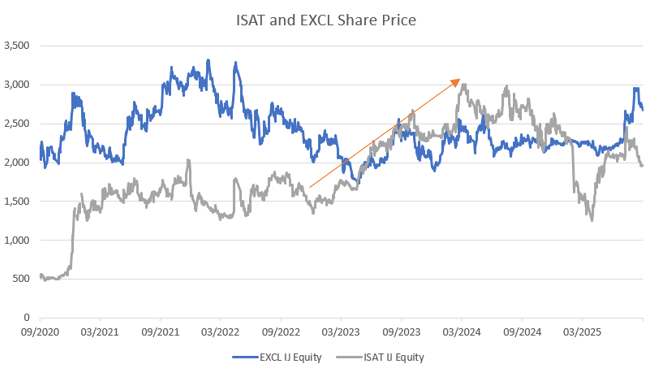

We’ve seen this play out before. When Indosat merged with Tri in 2022, the stock price rose sharply as investors priced in the benefits of scale and efficiency. What’s more, the rally didn’t stop at the initial move as the momentum continued in the following quarters as synergies translated into stronger earnings.

Today, EXCL’s merger with Smartfren is still in the early innings. The stock has yet to show a move of that magnitude, which suggests that there is still meaningful upside potential if the same pattern plays out. With synergies on track and earnings visibility improving, EXCL could be setting up for a rerating similar to what we saw with ISAT.

Our analyst highlights EXCL’s attractive valuation and maintains a BUY with a target price of Rp3,500, supported by expected synergy realization and ARPU growth. While near-term earnings may look pressured, the merger sets the stage for a stronger and more profitable future.

As expected, the transition comes with temporary costs. In 2Q25, EXCL reported a net loss of Rp1.6tn, largely from merger expenses and asset write-offs. This was not surprising given the scale of the integration. What matters more is that normalized EBITDA grew +10% yoy to Rp4.9tn, proving the core business remains solid through the transition.

The real excitement is in the synergy ahead. Management is targeting USD100–200mn in synergy value by 2025, potentially rising to USD300–400mn once integration is complete. Most of this will come from network efficiencies that lower costs and improve cash flow.

We’ve seen this play out before. When Indosat merged with Tri in 2022, the stock price rose sharply as investors priced in the benefits of scale and efficiency. What’s more, the rally didn’t stop at the initial move as the momentum continued in the following quarters as synergies translated into stronger earnings.

Today, EXCL’s merger with Smartfren is still in the early innings. The stock has yet to show a move of that magnitude, which suggests that there is still meaningful upside potential if the same pattern plays out. With synergies on track and earnings visibility improving, EXCL could be setting up for a rerating similar to what we saw with ISAT.

Our analyst highlights EXCL’s attractive valuation and maintains a BUY with a target price of Rp3,500, supported by expected synergy realization and ARPU growth. While near-term earnings may look pressured, the merger sets the stage for a stronger and more profitable future.

Written by Boris, the Broker

Comments