11 September 2025

Supporting Top-Down On Top of Strong Marketing Sales

Market Commentary

0 comments

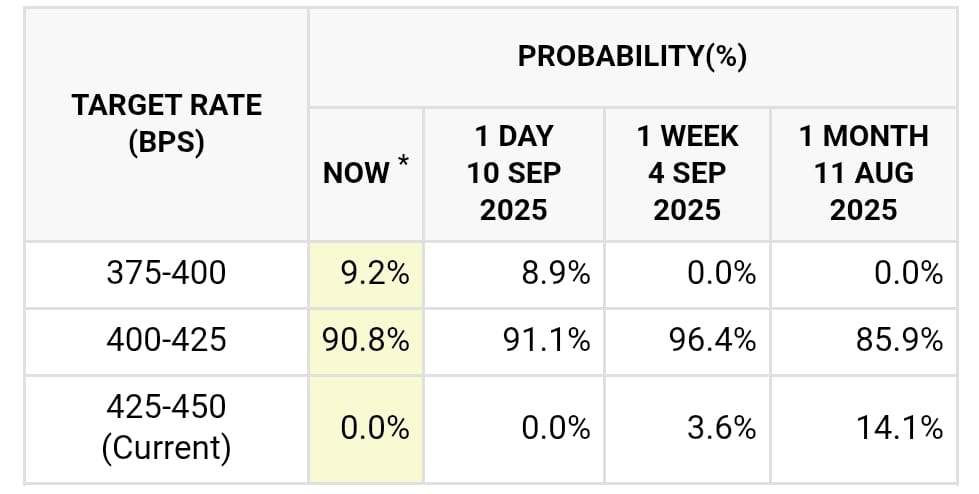

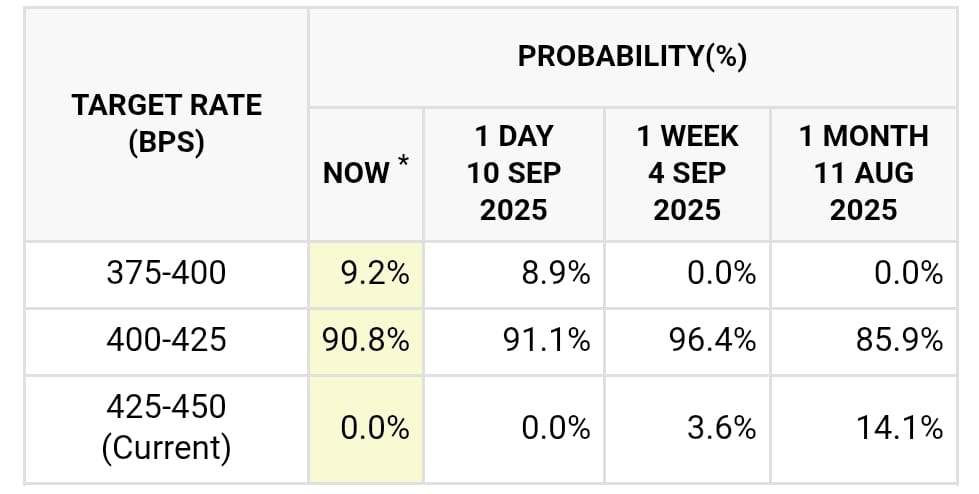

Economists are largely predicting that the Federal Reserve will cut its benchmark interest rate at the upcoming September FOMC meeting. Based on market probabilities, there is now a more than 90% chance that the target rate will be lowered to the 400–425 basis points range, down from the current 425–450 range.

The likelihood of a deeper cut to 375–400 basis points remains low, while expectations for the Fed to keep rates unchanged have almost disappeared.

Although the Fed rate cut may not immidately change deposit and lending rate in Indonesia, but we believe the trend of lower interest rates is giving positive sentiment for interest rates sensitive stocks, such as property stocks.

In 2Q25, SMRA posted soft earnings of IDR 265bn (-15% YoY), dragging 1H25 earnings to IDR504bn (-33% YoY). Despite weaker performance, results came in above expectations, reaching 63% of our FY25 estimate.

.jpeg)

On a positive note, 1H25 marketing sales reached IDR 2.2tn (+26% YoY), achieving 43% of the FY25 target, with Serpong accounting for 44% of the total. Importantly, SMRA recorded the strongest marketing sales growth among peers under our coverage.

.jpeg)

In our view, SMRA's valuation remains undemanding at 0.5x P/B and 9.1x P/E, compared to the three-year averages of 0.9x and 11.3x. Meanwhile, foreign ownership has declined to 16% (vs. the three-year average of 24%), providing significant room for renewed inflows. Backed by solid sales momentum and attractive upside, we reiterate our BUY call with a target price of IDR 676 per share.

The likelihood of a deeper cut to 375–400 basis points remains low, while expectations for the Fed to keep rates unchanged have almost disappeared.

CME Target Rate

Although the Fed rate cut may not immidately change deposit and lending rate in Indonesia, but we believe the trend of lower interest rates is giving positive sentiment for interest rates sensitive stocks, such as property stocks.

In 2Q25, SMRA posted soft earnings of IDR 265bn (-15% YoY), dragging 1H25 earnings to IDR504bn (-33% YoY). Despite weaker performance, results came in above expectations, reaching 63% of our FY25 estimate.

.jpeg)

On a positive note, 1H25 marketing sales reached IDR 2.2tn (+26% YoY), achieving 43% of the FY25 target, with Serpong accounting for 44% of the total. Importantly, SMRA recorded the strongest marketing sales growth among peers under our coverage.

.jpeg)

In our view, SMRA's valuation remains undemanding at 0.5x P/B and 9.1x P/E, compared to the three-year averages of 0.9x and 11.3x. Meanwhile, foreign ownership has declined to 16% (vs. the three-year average of 24%), providing significant room for renewed inflows. Backed by solid sales momentum and attractive upside, we reiterate our BUY call with a target price of IDR 676 per share.

Written by Boris, the Broker

Comments