22 October 2025

No Rush to Cut: BI Keeps Its Cool at 4.75%

Market Commentary

0 comments

Bank Indonesia once again took a cautious yet well-calibrated move. In its October Board of Governors meeting, BI decided to keep the benchmark rate unchanged at 4.75%, in line with our economist’s projection and slightly above market expectations that had been hoping for an early signal of easing. The message is clear: rupiah stability remains BI’s top priority amid global uncertainties and a still-strong US dollar.

.png)

On the domestic front, fundamentals remain solid. Loan growth in September rose 7.7% yoy, slightly higher than in August, while third-party funds (DPK) expanded 11.81% yoy. These figures underline that banking liquidity stays ample and credit demand is gradually picking up across key segments.

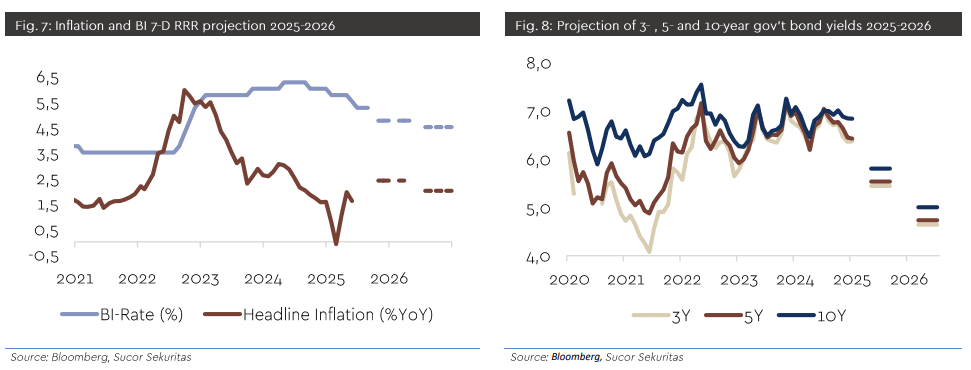

We believe BI’s stance reflects a balanced approach to maintaining currency stability while preserving growth momentum. By holding rates steady, BI reaffirms its pro-market policy direction, supporting lending activity while leaving room for potential rate cuts in 2026 once external pressures ease.

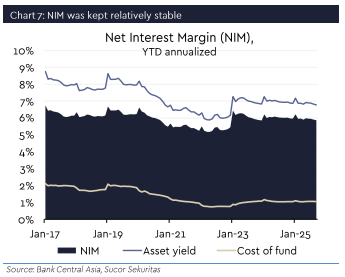

From a market perspective, the decision is neutral to mildly positive for both banks and government bonds. A stable rupiah and healthy liquidity environment could push the 10-year government bond yield lower, potentially toward 5.5% by year-end. As the Fed begins its rate-cut cycle, we expect foreign inflows to return, strengthening the rupiah and supporting risk assets into late 2025.

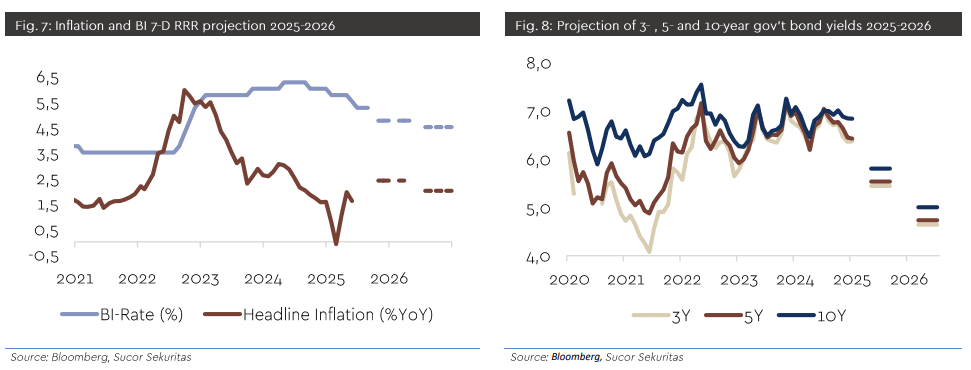

For the banking sector, this creates a sweet spot to preserve margins and support credit expansion, especially for major banks with strong CASA bases. BBCA, with its solid funding structure and consistent profit visibility, stands out as a key beneficiary in this environment. Its ability to sustain NIM while expanding loan growth positions it well ahead of the next easing cycle.

We believe the combination of rupiah stabilization and declining bond yields could act as a positive catalyst for a re-rating in big banks’ valuations, led by BBCA, toward year-end.

.png)

On the domestic front, fundamentals remain solid. Loan growth in September rose 7.7% yoy, slightly higher than in August, while third-party funds (DPK) expanded 11.81% yoy. These figures underline that banking liquidity stays ample and credit demand is gradually picking up across key segments.

We believe BI’s stance reflects a balanced approach to maintaining currency stability while preserving growth momentum. By holding rates steady, BI reaffirms its pro-market policy direction, supporting lending activity while leaving room for potential rate cuts in 2026 once external pressures ease.

From a market perspective, the decision is neutral to mildly positive for both banks and government bonds. A stable rupiah and healthy liquidity environment could push the 10-year government bond yield lower, potentially toward 5.5% by year-end. As the Fed begins its rate-cut cycle, we expect foreign inflows to return, strengthening the rupiah and supporting risk assets into late 2025.

For the banking sector, this creates a sweet spot to preserve margins and support credit expansion, especially for major banks with strong CASA bases. BBCA, with its solid funding structure and consistent profit visibility, stands out as a key beneficiary in this environment. Its ability to sustain NIM while expanding loan growth positions it well ahead of the next easing cycle.

We believe the combination of rupiah stabilization and declining bond yields could act as a positive catalyst for a re-rating in big banks’ valuations, led by BBCA, toward year-end.

Written by Boris, the Broker

Comments