23 October 2025

Supporting Macro Backdrop for a Strong Turnaround

Market Commentary

0 comments

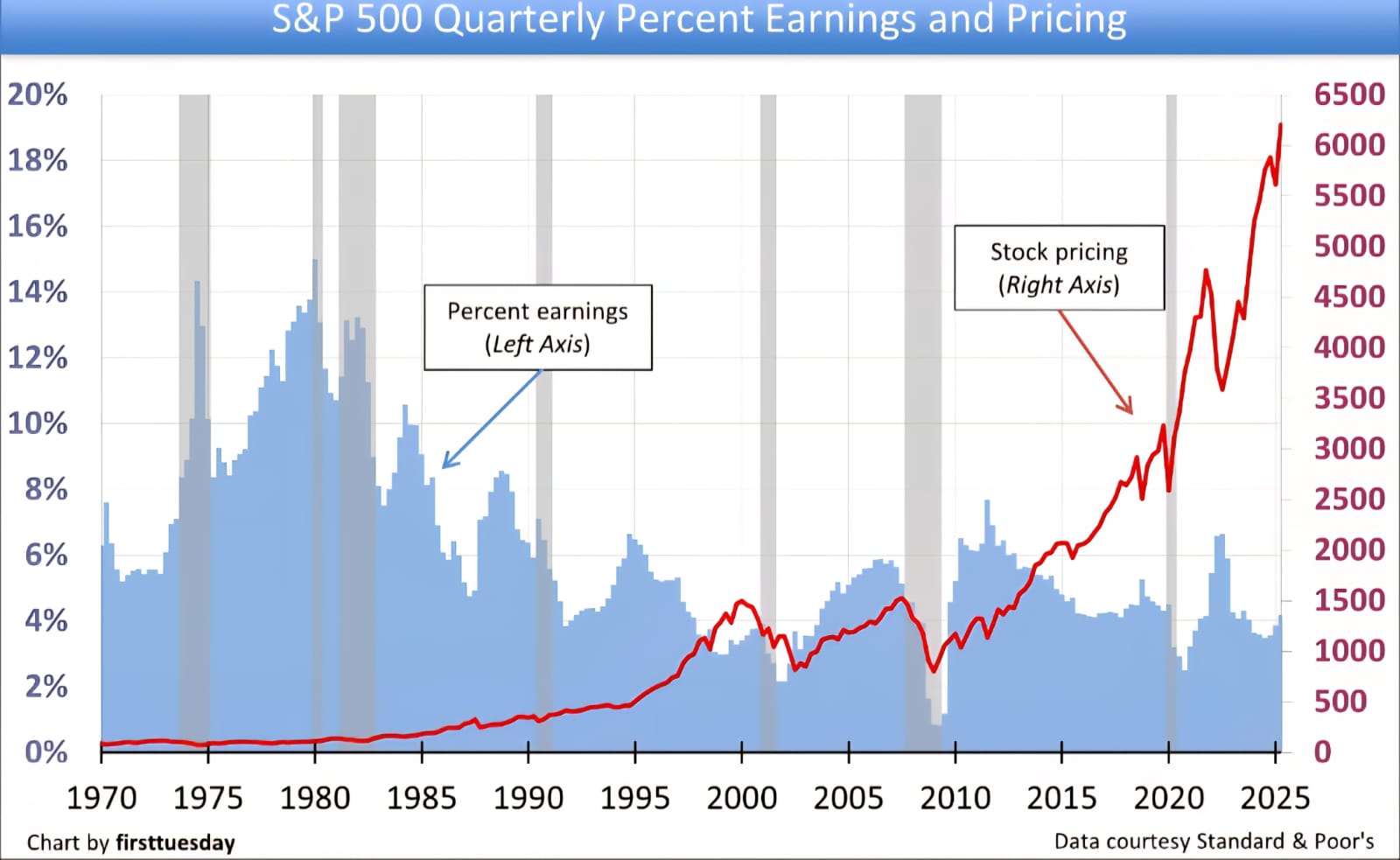

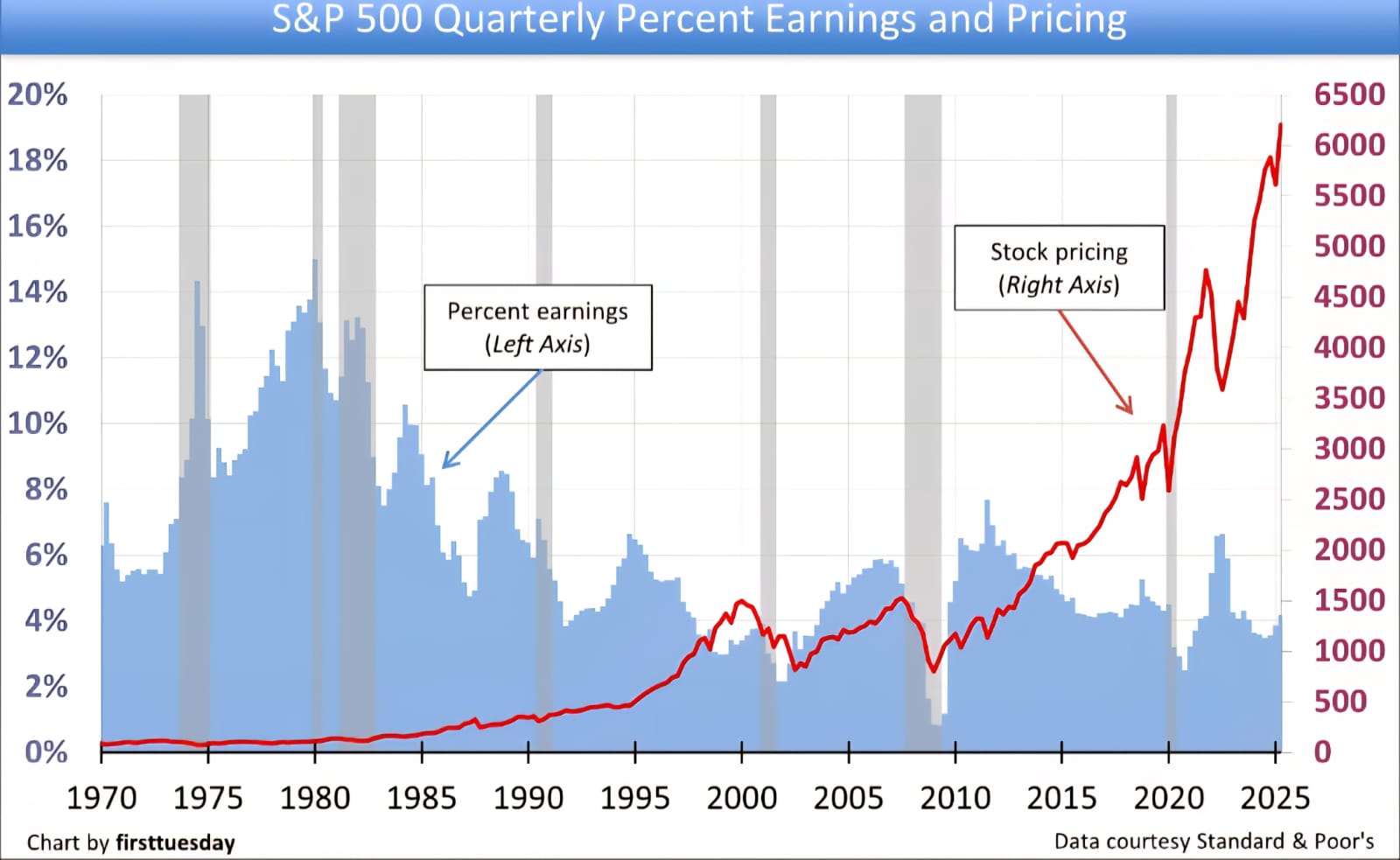

Investors today should remain cautious as valuations across various risky assets appear stretched. Global stock indices such as the S&P 500 and Nasdaq are trading near record highs relative to earnings. This suggests that asset prices may be running ahead of fundamentals, leaving markets vulnerable to corrections if economic growth slows or rates stay elevated longer than expected.

However, timing the market is notoriously difficult. Even the most renowned investors can be early — Michael Burry, known for predicting the 2008 housing crash, began shorting the U.S. housing market as early as 2005. Although his thesis was ultimately correct, the market continued rising for nearly two years before collapsing, testing his investors’ patience and capital. His case shows that while spotting overvaluation is possible, predicting exactly when it unwinds is not, which is why balanced risk management is often more prudent than outright market timing.

Indonesia’s IDR 200tn liquidity injection and the government’s plan to raise minimum wage by +9% YoY (2026F: Rp5.9mn) are set to boost purchasing power and domestic consumption. This creates a supportive backdrop for FMCG demand, especially among lower- to middle-income consumers.

For MYOR, stronger household spending should drive steady volume growth across its flagship brands. Backed by rising demand and stable input costs, MYOR is projected to deliver around +10% top-line growth and maintain a healthy 7.5% NPM in 2025F.

.jpeg)

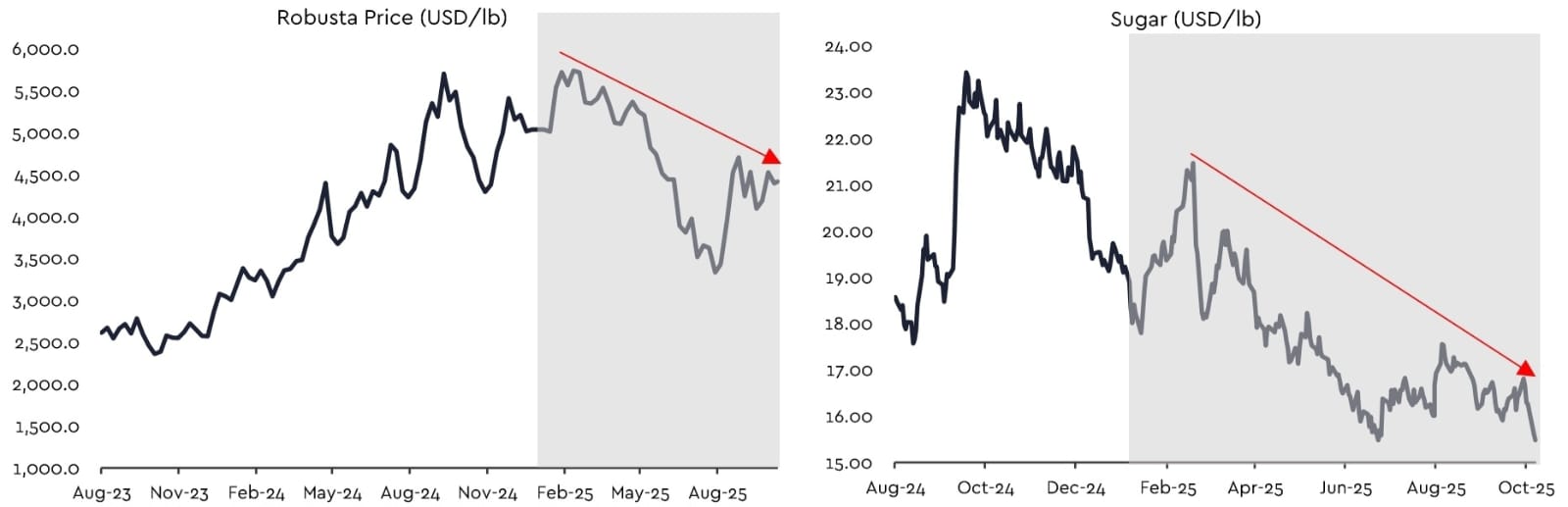

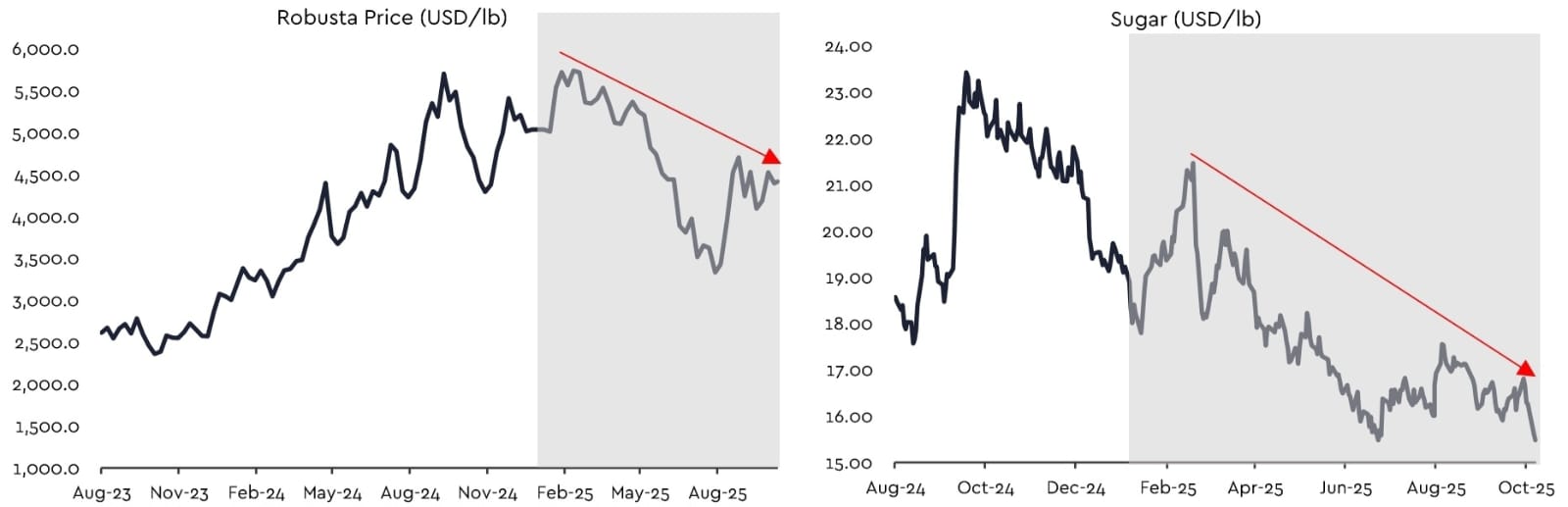

In 2Q25, the GPM declined to 20.3% (-160 bps qoq), primarily due to elevated coffee and cocoa prices. However, raw material costs have since moderated, with cocoa down 35% YTD, robusta 12%, sugar 22%, and CPO 7%. We expect GPM to recover to approximately 22% in FY25, approaching the four-year historical average of 24%.

We maintain our revenue forecasts at IDR 40tn for FY25F and IDR 44tn for FY26F, with net profit projected to ease to IDR 2.9tn in FY25F (-3% yoy) before rebounding to IDR 3.2tn in FY26F.

.jpeg)

We view the current share price weakness as an attractive entry opportunity. Reiterate BUY with a target price of Rp2,530, implying 17.5x 2026F P/E.

However, timing the market is notoriously difficult. Even the most renowned investors can be early — Michael Burry, known for predicting the 2008 housing crash, began shorting the U.S. housing market as early as 2005. Although his thesis was ultimately correct, the market continued rising for nearly two years before collapsing, testing his investors’ patience and capital. His case shows that while spotting overvaluation is possible, predicting exactly when it unwinds is not, which is why balanced risk management is often more prudent than outright market timing.

Indonesia’s IDR 200tn liquidity injection and the government’s plan to raise minimum wage by +9% YoY (2026F: Rp5.9mn) are set to boost purchasing power and domestic consumption. This creates a supportive backdrop for FMCG demand, especially among lower- to middle-income consumers.

For MYOR, stronger household spending should drive steady volume growth across its flagship brands. Backed by rising demand and stable input costs, MYOR is projected to deliver around +10% top-line growth and maintain a healthy 7.5% NPM in 2025F.

.jpeg)

In 2Q25, the GPM declined to 20.3% (-160 bps qoq), primarily due to elevated coffee and cocoa prices. However, raw material costs have since moderated, with cocoa down 35% YTD, robusta 12%, sugar 22%, and CPO 7%. We expect GPM to recover to approximately 22% in FY25, approaching the four-year historical average of 24%.

We maintain our revenue forecasts at IDR 40tn for FY25F and IDR 44tn for FY26F, with net profit projected to ease to IDR 2.9tn in FY25F (-3% yoy) before rebounding to IDR 3.2tn in FY26F.

.jpeg)

We view the current share price weakness as an attractive entry opportunity. Reiterate BUY with a target price of Rp2,530, implying 17.5x 2026F P/E.

Written by Boris, the Broker

Comments