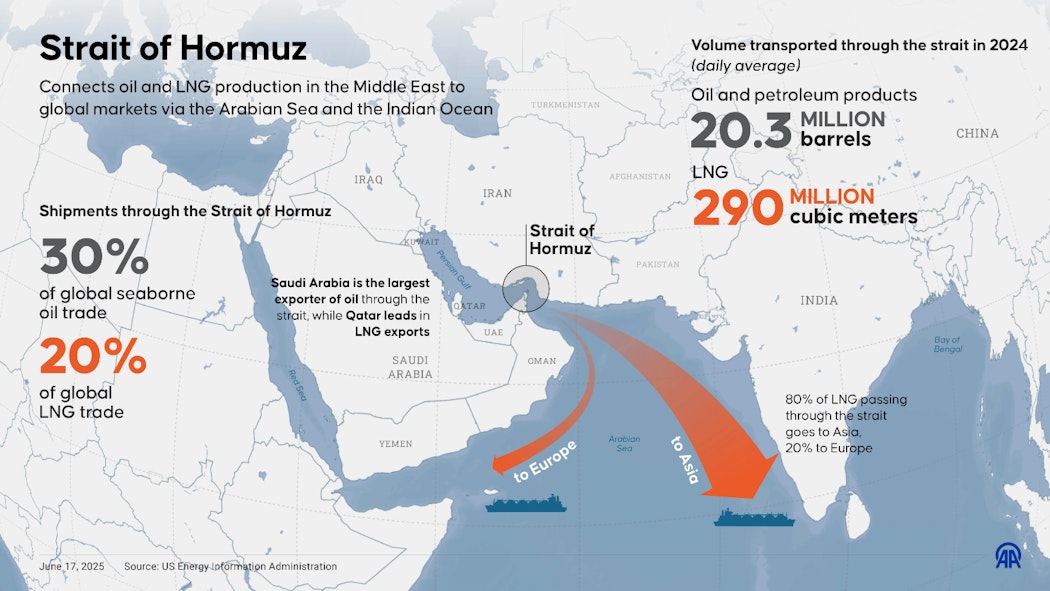

A potential closure of the Strait of Hormuz would send shockwaves far beyond the borders of Iran, the United States, or Israel—it would be a global economic crisis in the making. While often viewed through the lens of Western geopolitics, the strait’s importance extends across continents, deeply intertwining with the energy security of Asia, Europe, and beyond.

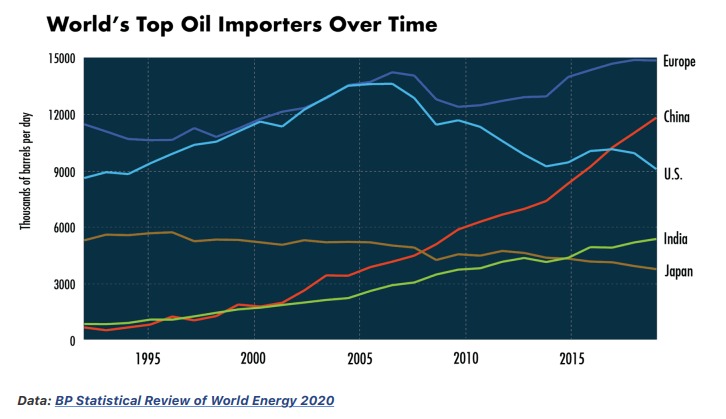

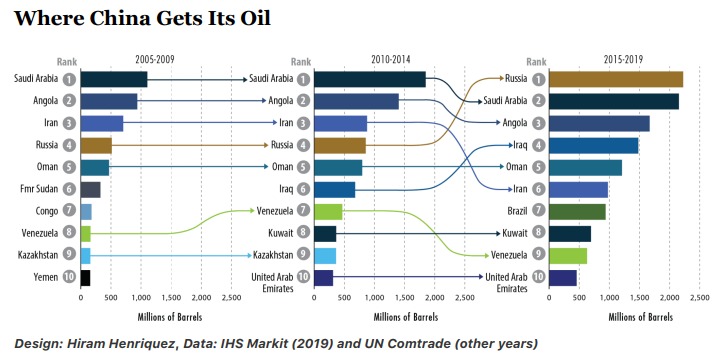

China as the world’s largest oil importer, China sources nearly 45% of its crude oil imports through the Strait of Hormuz. A disruption would immediately threaten China’s industrial output, energy stability, and broader economic momentum.

Similarly, other major Asian economies like Japan, South Korea, and India are also heavily reliant on oil that flows through this narrow waterway. These countries lack the strategic reserves or alternative supply routes needed to absorb a long-term disruption without significant economic consequences.

Moreover, the closure wouldn’t just affect oil-importing nations. Energy exporters in the Gulf—such as Saudi Arabia, the UAE, and Iraq—would see their revenues plunge overnight, with global markets thrown into turmoil. Shipping insurance premiums would soar, transportation costs would spike, and inflationary pressure would ripple across global supply chains—from fuel prices to food and manufacturing costs.

This sentiment is also reflected in Brent crude oil prices, which have begun to decline—likely driven by the ongoing trend of de-escalation and investors’ confidence that the Strait of Hormuz will remain open.

Brent Crude Oil Price (taken around June 24th, 15.00 Jkt time)

.png)

Therefore, we believe that since demand for oil is likely to remain stable with no strong catalyst for significant growth—and supply disruptions may not be as severe as initially feared—oil prices are likely to stay stable and relatively low. We also believe this trend will likely persist, as it aligns with Trump’s interest in cooling inflation by pushing down oil and commodity prices, ultimately helping to lower yields as the U.S. prepares for its large-scale COVID-related debt restructuring.

In our view, this may be a good time to trim exposure to oil-related stocks and take profit, as oil proxy stocks in Indonesia (e.g., MEDC, ENRG) have experienced a strong rally recently. That said, given the current uncertainties, we remain in favor of selected commodity stocks such as AADI, BRMS, and DEWA.

Comments