03 September 2025

The Strong Rebound of JCI

Market Commentary

0 comments

JCI managed to rebound following the big hit from political instability the past few days. While JCI still booked a net foreign outflow on 2nd September, it still managed to close higher than the day before. Beside the stabilizing political issue, we believe Indonesia's strong macro backdrop plays an important role as well.

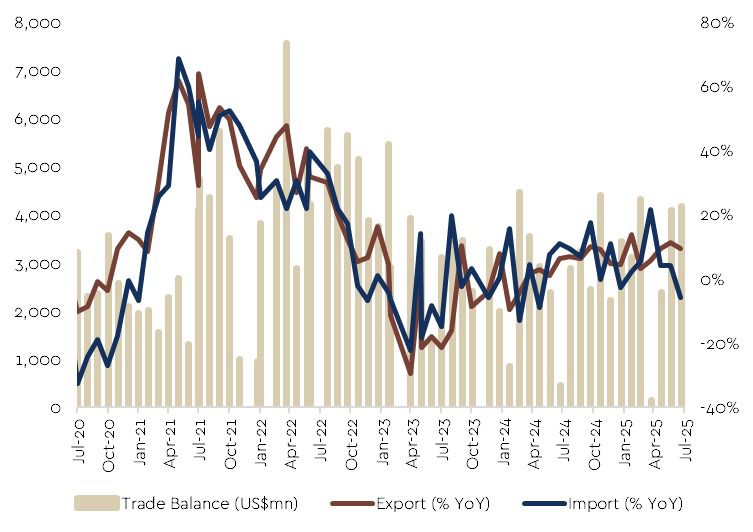

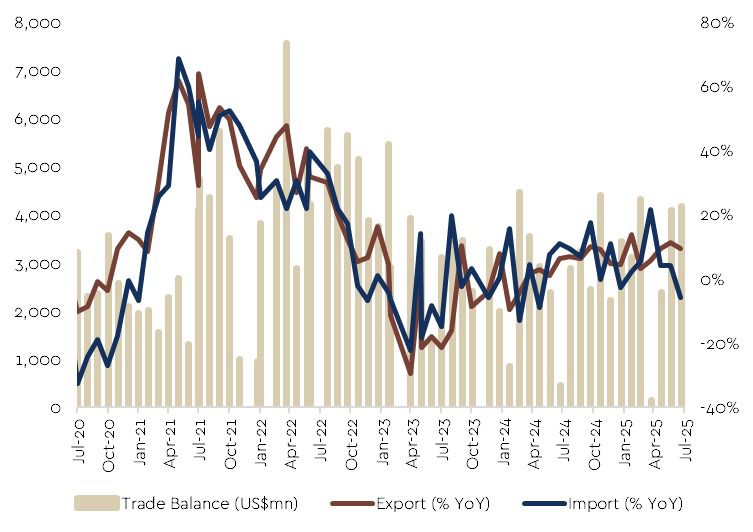

Indonesia’s trade balance posted a USD 4.18bn surplus in July, exceeding both consensus and internal forecasts (USD 3bn and USD 4bn, respectively), and marking its 63rd consecutive month of surplus. Export growth slowed to 9.86% YoY, while imports declined 5.86% YoY.

Looking forward, firm capital goods imports and a rebound in the Manufacturing PMI to 51.5 highlight improving investment and production momentum in 3Q25. The stability of the 10-year government bond yield offers a base for equity market recovery, while liquidity injections by Bank Indonesia are expected to boost loan disbursement.

Meanwhile, Indonesia’s CPI eased to 2.31% YoY in August from 2.37% in July. On a monthly basis, CPI posted a slight deflation of -0.08%. Core inflation moderated to 2.17% YoY, administered prices slowed to 1.00% YoY following fuel price cuts, while volatile food inflation rose to 4.47% YoY, mainly driven by higher rice prices. Food, beverages, tobacco, and personal care remained the largest contributors to annual inflation.

The August figure marked the highest level since June 2024, yet the overall disinflation trend remains intact, supported by stable exchange rates despite recent unrest. The government’s latest stimulus package—including housing incentives, tourism support, and meal programs—along with accommodative fiscal and monetary policies, is expected to keep inflation low through year-end.

.jpeg)

We believe this environment strengthens the case for further BI-Rate cuts to support growth and liquidity.

In our view, liquidity injections by BI when combined with strong capital inflows and growing expectations of further rate cuts, can help support the projection that the 10-year yield could decline toward 5.80% by year-end.

Hence, interest rate sensitive stocks such as banks would be a good investment option as most bank stocks currently offers undemanding valuation.

Indonesia’s trade balance posted a USD 4.18bn surplus in July, exceeding both consensus and internal forecasts (USD 3bn and USD 4bn, respectively), and marking its 63rd consecutive month of surplus. Export growth slowed to 9.86% YoY, while imports declined 5.86% YoY.

Looking forward, firm capital goods imports and a rebound in the Manufacturing PMI to 51.5 highlight improving investment and production momentum in 3Q25. The stability of the 10-year government bond yield offers a base for equity market recovery, while liquidity injections by Bank Indonesia are expected to boost loan disbursement.

Indonesia's Trade Surplus

Meanwhile, Indonesia’s CPI eased to 2.31% YoY in August from 2.37% in July. On a monthly basis, CPI posted a slight deflation of -0.08%. Core inflation moderated to 2.17% YoY, administered prices slowed to 1.00% YoY following fuel price cuts, while volatile food inflation rose to 4.47% YoY, mainly driven by higher rice prices. Food, beverages, tobacco, and personal care remained the largest contributors to annual inflation.

The August figure marked the highest level since June 2024, yet the overall disinflation trend remains intact, supported by stable exchange rates despite recent unrest. The government’s latest stimulus package—including housing incentives, tourism support, and meal programs—along with accommodative fiscal and monetary policies, is expected to keep inflation low through year-end.

.jpeg)

We believe this environment strengthens the case for further BI-Rate cuts to support growth and liquidity.

In our view, liquidity injections by BI when combined with strong capital inflows and growing expectations of further rate cuts, can help support the projection that the 10-year yield could decline toward 5.80% by year-end.

Hence, interest rate sensitive stocks such as banks would be a good investment option as most bank stocks currently offers undemanding valuation.

Written by Boris, the Broker

Comments