Indonesia’s macroeconomic backdrop in mid-2025 appears increasingly solid, underpinned by a favorable inflation trajectory, prudent policy measures, and supportive external conditions.

The latest inflation print for May reinforces this outlook, with headline consumer prices rising just 1.60% year-on-year, down from 1.95% in April and coming in below both market and internal projections. On a monthly basis, the economy experienced deflation of -0.37%, largely due to a post-Ramadan and Eid consumption normalization.

This seasonal moderation is consistent with past trends, and indicates no structural inflationary pressures at this stage.

.png)

With inflation slowing and the rupiah remaining stable, Bank Indonesia has significant room to maintain its accommodative stance. The May inflation data supports expectations for a 25 basis point policy rate cut in June, a move that would help stimulate domestic demand without endangering price stability. Furthermore, the combination of soft inflation and stable currency dynamics should support a continued decline in government bond yields, with the 10-year yield likely trending toward 5.8% by year-end.

Aside from moderate inflation, Indonesia's trade balance also strengthen Indonesia's macro backdrop.

Indonesia’s export performance remained robust in April 2025 despite prevailing external headwinds, with notable growth in shipments to the United States, which rose by 18.4% YoY—even in the face of newly imposed tariffs. Exports to key trading partners such as China, ASEAN member states, and the European Union also registered continued expansion.

Non-OG Exports to Major Trading Partner (USD bn) Non-OG Exports vs Non-OG Imports (%YoY)

.jpeg)

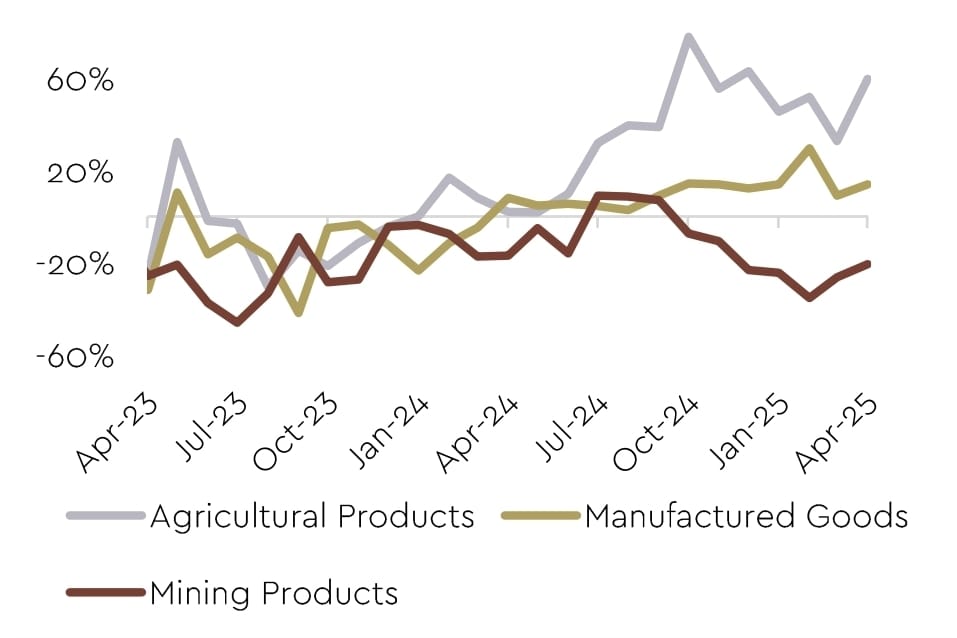

The rebound in manufacturing exports, alongside a significant increase in agricultural exports, effectively offset the contraction observed in the mining sector. Thus far, the impact of ongoing global trade tensions on Indonesia’s external sector has been limited, and the prospect of a global trade agreement could further bolster this resilience.

Meanwhile, there has been a marked increase in imports of capital goods and raw materials, particularly in machinery, electrical equipment, and plastics. This trend suggests a potential revival in domestic manufacturing activity and a pickup in investment momentum during the second quarter of 2025. A recovery in manufacturing is expected to support a return of GDP growth to around 5.0%.

Exports by Economic Sector

Looking ahead, Indonesia’s trade surplus is projected to improve in the May–June period, supported by rising coal prices and a continued decline in oil imports. Capital inflows are also anticipated to strengthen, contributing to greater exchange rate stability and an expected appreciation of the rupiah toward IDR15,100 / USD by the end of 2025.

Comments