Indonesia’s equity market was hit hard yesterday, with the JCI plunging 1.87% to 8,117, after briefly touching an intraday low near 7,959. The selloff was triggered by MSCI’s announcement of a public consultation on a potential revision to its free float calculation methodology, specifically for Indonesian constituents. Although this remains purely a proposal with no final decision yet, the market reaction underscored how sensitive investors are to the potential implications of such changes.

Under the proposed methodology, MSCI plans to adopt a more conservative approach based on shareholding data from KSEI. Holdings classified under “Corporate” and “Others” would be treated as non-free float, which could reduce the portion of tradable shares recognized in the index. As a result, several large names including CUAN, ICBP, KLBF, and INDF might risk exclusion from MSCI’s indices.

While the earliest possible implementation would be in the May 2026 review, and the consultation period runs until December 31, 2025, investors opted to react swiftly. The main concern remains the potential for large-scale foreign outflows, as several Indonesian stocks have historically benefited from rounding adjustments in MSCI’s methodology.

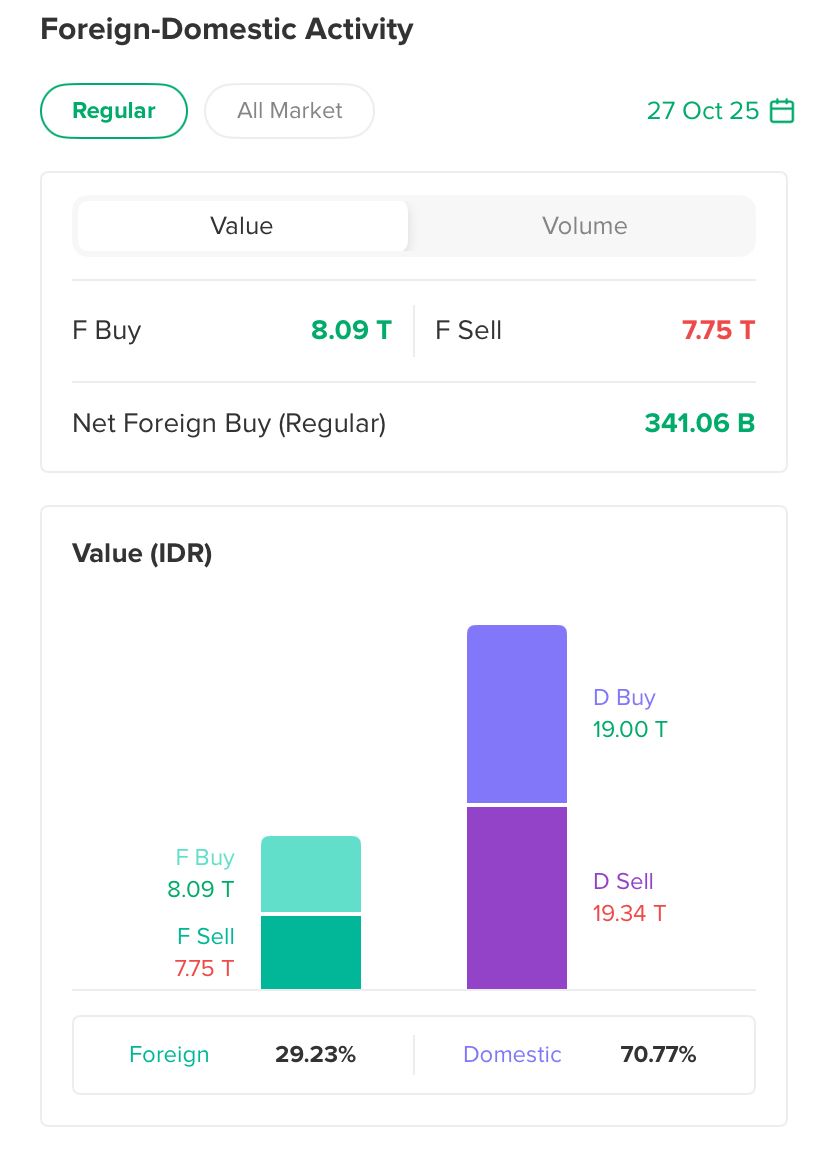

Despite the sharp decline, foreign flows remained relatively balanced, recording a modest net buy of around IDR 341 billion. This suggests that the selling pressure came primarily from domestic investors, while foreigners stayed on the sidelines rather than exiting aggressively. The market’s move, therefore, appears to reflect panic-driven sentiment more than any shift in underlying fundamentals.

In the short term, volatility may persist, especially among low-float names. However, the broader outlook remains unchanged — this is still a proposal, not a policy. For selective investors, the recent weakness could open opportunities to accumulate quality mid-cap names such as WIFI, whose fundamentals remain solid amid the current market volatility.