28 October 2025

Fundamentally Justified Alpha Picks

Market Commentary

0 comments

WIFI IJ recently held a public expose outlining its plan to accelerate the rollout of its Fixed Wireless Access (FWA) service. The announcement came shortly after the stock experienced a sharp decline between October 15 and 17, as investor sentiment weakened amid sell-on-news profit-taking and broader market volatility. The company’s renewed communication aims to reassure investors and emphasize its growth prospects in expanding broadband connectivity through FWA technology.

WIFI’s sharp share price decline between October 15 and 17, 2025 occurred shortly after news broke that the company had won the Region 1 (Java area) 1.4 GHz spectrum bid for around Rp404 billion. While the win signaled a positive long-term step for network expansion, the market reacted negatively in the short term as investors possibly engaged in profit-taking following the stock’s prior rally.

WIFI’s FWA service is currently in the pre-registration phase for its Rp100,000-per-month, 100 Mbps internet package. The initial rollout is scheduled for November 2025, followed by a commercial launch planned for early next year.

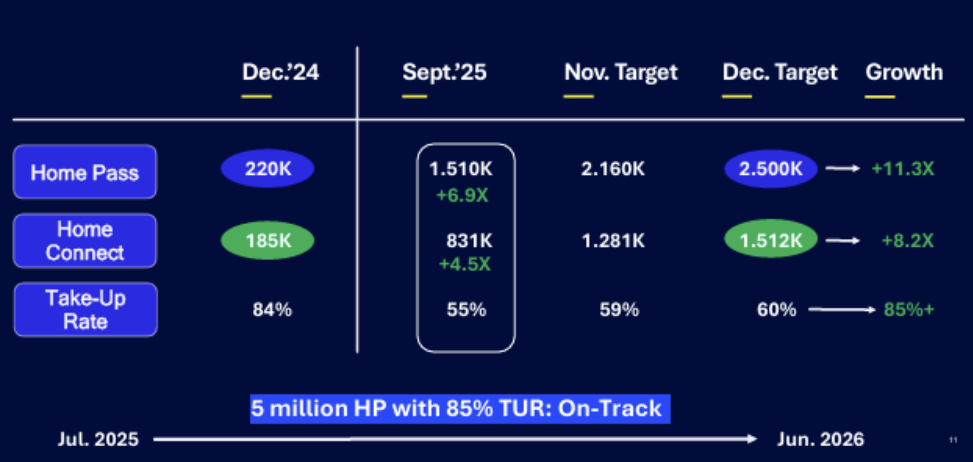

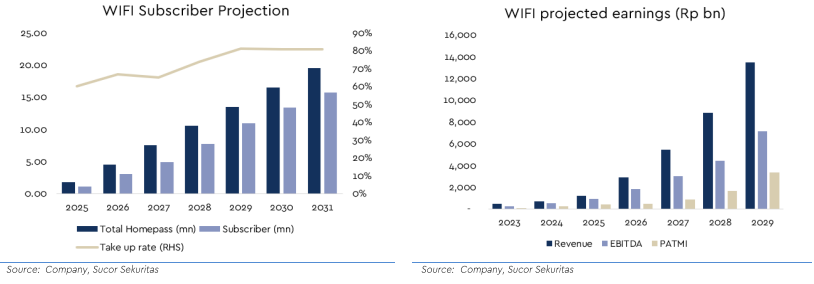

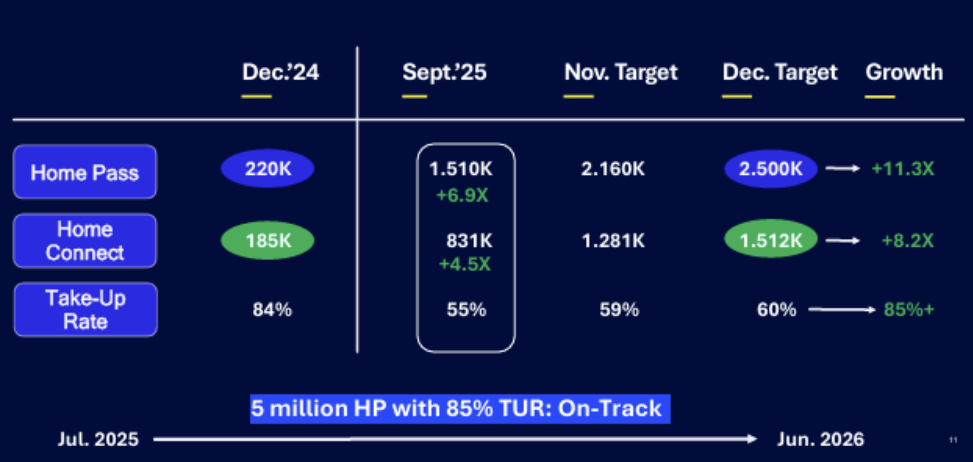

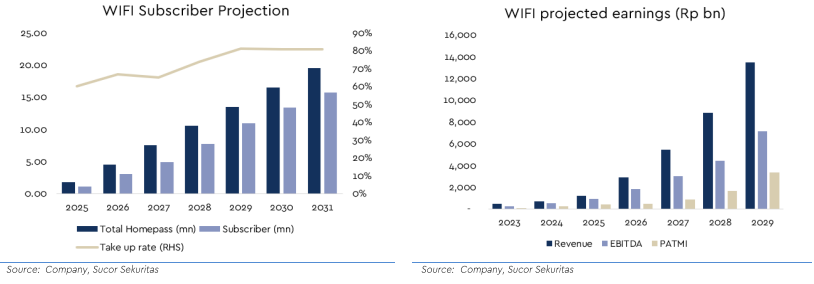

As of September 2025, WIFI had reached 1.5 million homes passed and 831,000 home-connect subscribers, representing a 55% take-up rate. The company targets 2.5 million homes passed and 1.5 million home-connect subscribers (a 60% take-up rate) by year-end, driven entirely by its FTTH network. By June 2026, WIFI aims to expand to 5 million homes passed with an estimated ~85% take-up rate, supported by the rollout of its Fixed Wireless Access (FWA) service, which is expected to add up to 1 million homes passed per month starting in early 2026.

WIFI is also participating in the bidding process to acquire LINK from Axiata, which currently operates 4.4 million homes passed and 1 million connections under XL Home (approximately 22% take-up). Should WIFI succeed in the acquisition and improve the take-up rate to 50% under its Rp250,000-per-month, 500 Mbps plan, the company could potentially generate around Rp13 trillion in revenue and Rp8 trillion in EBITDA, assuming a 60% margin.

We reiterate our BUY recommendation with a target price of Rp9,500 per share. WIFI remains a disruptive player in Indonesia’s telecommunications market. Applying a ~20x P/E multiple to its FY2030 EPS implies a valuation of approximately Rp22,124 per share, translating to a ~47% compound annual growth rate (CAGR) in potential capital gains from current levels.

WIFI’s sharp share price decline between October 15 and 17, 2025 occurred shortly after news broke that the company had won the Region 1 (Java area) 1.4 GHz spectrum bid for around Rp404 billion. While the win signaled a positive long-term step for network expansion, the market reacted negatively in the short term as investors possibly engaged in profit-taking following the stock’s prior rally.

WIFI’s Share Price Performance

WIFI’s FWA service is currently in the pre-registration phase for its Rp100,000-per-month, 100 Mbps internet package. The initial rollout is scheduled for November 2025, followed by a commercial launch planned for early next year.

As of September 2025, WIFI had reached 1.5 million homes passed and 831,000 home-connect subscribers, representing a 55% take-up rate. The company targets 2.5 million homes passed and 1.5 million home-connect subscribers (a 60% take-up rate) by year-end, driven entirely by its FTTH network. By June 2026, WIFI aims to expand to 5 million homes passed with an estimated ~85% take-up rate, supported by the rollout of its Fixed Wireless Access (FWA) service, which is expected to add up to 1 million homes passed per month starting in early 2026.

Home Connect and Home Pass Achievement and Target

WIFI is also participating in the bidding process to acquire LINK from Axiata, which currently operates 4.4 million homes passed and 1 million connections under XL Home (approximately 22% take-up). Should WIFI succeed in the acquisition and improve the take-up rate to 50% under its Rp250,000-per-month, 500 Mbps plan, the company could potentially generate around Rp13 trillion in revenue and Rp8 trillion in EBITDA, assuming a 60% margin.

We reiterate our BUY recommendation with a target price of Rp9,500 per share. WIFI remains a disruptive player in Indonesia’s telecommunications market. Applying a ~20x P/E multiple to its FY2030 EPS implies a valuation of approximately Rp22,124 per share, translating to a ~47% compound annual growth rate (CAGR) in potential capital gains from current levels.

Written by Boris, the Broker

Comments